สล็อตเว็บตรงเว็บไหนดี สล็อตแตกง่าย PUNPRO777.com 19 September 2022 เว็บตรง 100% เนื่องจากว่าคนนิยมเล่นเครดิตฟรี777 สล็อตออนไลน์ เคดิตฟรี

สล็อตเว็บตรงเว็บไหนดี สล็อตแตกง่าย PUNPRO777.com 19 September 2022 เว็บตรง 100% เนื่องจากว่าคนนิยมเล่นเครดิตฟรี777 สล็อตออนไลน์ เคดิตฟรี

เว็บไซต์สล็อตที่มาแรงในช่วงเวลานี้ ที่ดีไม่เหมือนใคร คุ้มสุดๆ

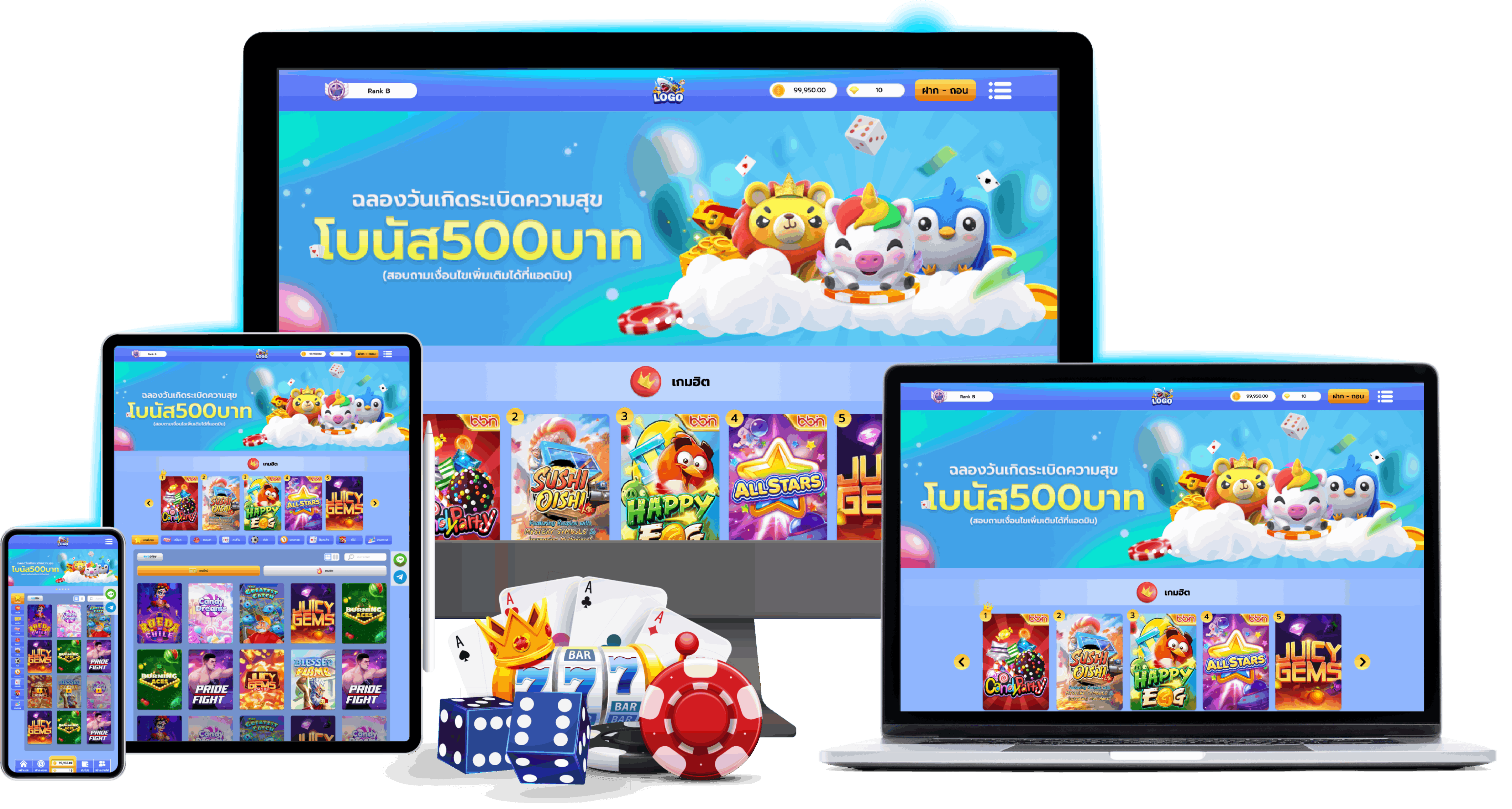

เว็บเกมสล็อตออนไลน์ สล็อต ที่มาแรงที่สุดในเวลานี้ มีเกมให้เข้าใช้บริการมากยิ่งกว่าผู้ใดกันแน่ แตกหลายครา แตกไว รางวัลใหญ่มาก มีงบประมาณน้อยก็สามารถเข้ามาเลือกเล่นได้ทุกเกม เล่นง่าย พบกับความเพลิดเพลินได้ทั้งวัน แล้วหลังจากนั้นก็เมื่อได้เข้ามาเล่นกับ เว็บสล็อต ก็เตรียมพร้อมลุ้นรับเงินทองก้อนโตวันแล้ววันเล่าได้เลย แจกเครดิตฟรี ไม่ว่าจะเข้าเล่นตอนไหน ก็จะได้สัมผัสกับเงินโตอย่างฉับพลัน ทั้งหมดพวกเรายังได้มีการเปลี่ยนเกมสล็อตทั้งสิ้น ให้เป็นแบบอย่างเวอร์ชันใหม่ตอนนี้ รับรองว่าแม้ได้เข้าเล่น ทุกคนจะได้รับความบันเทิงแบบไม่ซ้ำใคร แถมยังได้มีการ รวมสล็อตเว็บตรง รวมถึงได้คัดสรรเกมความสามารถจากเว็บ punpro777.com

บริการยอดเยี่ยม ผู้เล่นพร้อมแล้วสำหรับคุณ

เว็บไซต์ตรงไม่ผ่านเอเย่นต์ ที่มีผู้เล่นเข้าใช้บริการจำนวนไม่ใช่น้อย รวมทุกค่ายเกมเปิดใหม่ ให้บริการเกมจำนวนมากว่า มีแม้กระนั้นเกมที่แตกบ่อยครั้ง รางวัลใหญ่แตกประจำ ถอนได้ไม่ยั้ง เล่น สล็อตเว็บตรง ได้วันละเป็นล้านก็สามารถถอนออกได้ ลุ้นรับทรัพย์สินได้ทุกๆวัน ถ้าหากได้ตกลงปลงใจเข้ามาร่วมเบิกบานกับ สล็อตแตกง่าย จังหวะที่จะเป็นคนรวยก็อยู่ไม่ไกล เป็นเว็บไซต์ที่มาแรงกว่าคนใดกันแน่ ให้บริการตามมาตรฐานสากล แถมยังเปิดรองรับผู้เล่นทั่วทั้งโลก ถ้าคนใดกันแน่ที่อยากได้เล่นเกมสล็อตที่ตอบปัญหา บอกเลยว่าจำเป็นต้องมาเล่นที่ตรงนี้แค่นั้น จบในที่เดียว ค้ำประกันว่าจะชื่นชอบจนกระทั่งไม่คิดที่จะเปลี่ยนเว็บไซต์อีกเลย

เว็บไซต์ดังรันวงการสล็อตเว็บ สล็อตแตกง่าย มาแรงที่สุดในปี 2022 จัดแจกโบนัสให้สมาชิกแบบไม่ยั้ง ไม่ว่าสมาชิกจะเป็นใครกันแน่หน้าไหน ก็ได้จังหวะได้รับโบนัสกับพวกเรา แบบจัดหนักจัดเต็ม แค่เพียงเปิดใจเล่นเกมสล็อตในเว็บไซต์ตรง สล็อตแตกง่าย ของพวกเราเพียงแค่นั้น ไม่แปลกใจเลยที่เว็บไซต์สล็อตเว็บตรงของเราดีจนได้ขึ้นเป็นท็อปชั้น 3 ในวงการสล็อต

ก็แค่ค้นหาชื่อ สล็อต punpro เว็บไซต์ตรงไม่ผ่านเอเย่นต์ไม่มีอย่างต่ำ ใน Google ก็จะขึ้นเว็บของพวกเราเป็นลำดับแรกแล้ว ดีเพียงใดปังขนาดไหนสมาชิกก็ลองคิดดูเอาเอง หากว่าเคยเล่นเว็บไซต์สล็อตเล่นแล้วมิได้เงินจริง ปัญหานั้นจะไม่เกิดกับสมาชิกอย่างแน่นอน ด้วยเหตุว่าทางเว็บ สล็อตแตกง่าย ไม่ว่าจะทำยอดได้เยอะแค่ไหน ก็จัดแจงรับเงินกลับไปอยู่บ้านไปเลย แถมมีแบบอย่างเกม เรื่อง แสงสว่าง สี เสียง สุดยอดเยี่ยม วันนี้จะมาชี้นำ 5 สัญลักษณ์สุดพิเศษ ที่รู้ไว้จะสามารถคว้าเงินล้าน ไปกับเว็บไซต์ของเราได้อย่างแน่นอน

มั่นอกมั่นใจได้เลยว่าดีที่สุดแน่ๆ

ถ้าหากสมาชิกยังไม่แน่ใจว่าเว็บไซต์ สล็อตแตกง่าย ของพวกเราจะจ่ายสมาชิกจริงไหม สามารถลงพนันในเว็บสล็อตแตกหลายครั้ง จำนวนเงินน้อยๆมองก็ได้ ประกันได้เลยว่ายอดเงินนั้นจะเปลี่ยนเป็นเงิน หลักแสน หลักล้าน ภายในสารเลวข้ามคืน แล้วทางเว็บ สล็อตแตกง่าย ก็จะจ่ายให้สมาชิกจริงๆเพียงแต่ เพียงแค่กดทำรายการถอนเข้ามา รวมทั้งยังมีขั้นตอนน้อยมากๆมีวิธีการสอนแนวทางการเบิกเงินออกมาจาก เว็บไซต์อย่างละเอียด

สามารถอ่านถึงที่กะไว้หน้าเว็บได้เลย รวมทั้งระบบฝากถอนของเว็บเราเร็วทันใจ ใน 10 วินาที ไม่ต้องให้สมาชิกรอนานให้เสียเวล่ำเวลา ด้วยเหตุว่ามีการบริการ โอนเงินฝากบัญชีสมาชิกโดยตรง โดยที่ไม่ต้องผ่านคนกลาง ไม่จำเป็นต้องกลุ้มใจเลยว่าจะถูกโกงไหม ทาง สล็อตแตกง่าย ได้เปิดทำมาค่อนจะหลายปี เป็นมือโปรในการดำเนินงานสุดๆย

เว็บตรงที่มาแรงแซงทางโค้ง ในปี 2022 ยังติดท็อป 3 อันดับ แรกในแวดวง ปังที่สุด เหมาะสมที่สุดที่สุด และเด็ดที่สุดในเขตนี้ เล่นกับเว็บไซต์พวกเราจ่ายจริงแน่นอน 100% ไม่ว่าจะยอดเงินเท่าไรก็จัดเตรียมรับเงินกันกลับบ้านแบบปังๆไปเลย แถมมีต้นแบบเกมที่สุดยอดสุดๆพิเศษน่าสนใจเยอะแยะ ใครๆเล่นก็ต่างมองว่าต้นแบบเกมตอบปัญหาสมาชิกได้ทุกคน มีเสนอแนะสัญลักษณ์ 5 สัญลักษณ์ที่สมาชิกควรรู้ประจำตัวไว้ เพื่อจะได้ทราบเรื่องในตัวเกมเยอะขึ้น และจากนั้นก็สามารถอ่านเกมออกได้ง่ายขึ้น เพื่อจะปราบเงินรางวัลกับเว็บ สล็อตแตกง่ายของพวกเรา

เว็บไซต์เด็ด ระดับโลก เชื่อเลยว่าคุ้มรวมทั้งดี

เร่าร้อนสุดๆในปีนี้ก็จะต้องที่ตรงนี้เลย สล็อตแตกง่าย เว็บไซต์สล็อตเบอร์ 1 ของโลก ผู้เล่นจะได้เจอกับสีสันความยอดเยี่ยม สมรรถนะสุดยอด มีเกมสล็อตให้เล่นนับพัน เลือกเล่นได้ตามสไตล์ แถมยังขึ้นชื่อลือชาด้าน สล็อตแตกง่าย กว่าเว็บปกติ แตกบ่อยครั้ง จริงมิได้ฉ้อโกง เข้าเล่นได้กำไรได้แต่ละวัน ตื่นเต้นไปกับความล้ำยุคของฟังก์ชั่นใหม่ๆที่เว็บไซต์ สล็อตแตกง่าย ได้มีการปรับแต่งอยู่บ่อยมาก

ยังมีมาตรฐานที่ยอดเยี่ยม จ่ายเต็ม จ่ายแน่นอน ไม่มีหักอะไรก็แล้วแต่ทั้งสิ้น นำเข้าเกม สล็อตแตกบ่อยครั้งที่สุด ลิขสิทธิ์แท้จากค่ายชั้นแนวหน้า เชื่อถือได้เลยว่าผู้เล่นจะสนุกสนานกว่าที่เคยผ่านมา เข้าเล่นผ่านทาง สล็อตแตกง่าย ได้ตลอดวัน ถึงท่านจะเป็นมือใหม่ก็เล่นได้สบายๆปั่นสล็อตสุดฟิน แจ็คพอตแตกกระจายหลายเท่า ที่สำคัญยังมีระบบ ฝาก-ถอน ออโต้ ที่ฉับไว สมัครเข้าเลยอย่ารอช้า ความสนุกสนานยังคอยท่านอยู่อีกเยอะแยะ

ไม่มีเว็บไซต์ไหนดีมากกว่าที่นี่อีกแล้ว

ไม่มีเว็บไซต์ไหนดีมากกว่าที่นี่อีกแล้ว

ไม่มีที่แหน่งใดจะน่าเล่น น่าโดนไปกว่า สล็อตแตกง่าย เว็บไซต์ความสามารถที่นี้อีกแล้ว เนื่องจากเราได้เก็บรวบรวมค่ายชั้นแนวหน้าจากทั่วทั้งโลก มาไว้ให้เล่นกันได้แบบจุใจในเว็บเดียว โดยที่ไม่ต้องไปเสียเวล่ำเวลาเล่นผ่านเว็บไซต์เอเย่นต์ ให้เสี่ยงขาดทุนอีกต่อไป ผู้เล่นสามารถร่วมบันเทิงใจไปกับกันได้แบบง่ายๆมีระบบระเบียบทันสมัย เข้าเล่นเสถียร ไม่มีดีเลย์หรือช้า

ไม่มีที่แหน่งใดจะน่าเล่น น่าโดนไปกว่า สล็อตแตกง่าย เว็บไซต์ความสามารถที่นี้อีกแล้ว เนื่องจากเราได้เก็บรวบรวมค่ายชั้นแนวหน้าจากทั่วทั้งโลก มาไว้ให้เล่นกันได้แบบจุใจในเว็บเดียว โดยที่ไม่ต้องไปเสียเวล่ำเวลาเล่นผ่านเว็บไซต์เอเย่นต์ ให้เสี่ยงขาดทุนอีกต่อไป ผู้เล่นสามารถร่วมบันเทิงใจไปกับกันได้แบบง่ายๆมีระบบระเบียบทันสมัย เข้าเล่นเสถียร ไม่มีดีเลย์หรือช้า

ไม่น่าเบื่อ สล็อตแตกง่าย สล็อต punpro ก็ยังเต็มไปด้วยเกมสล็อตแนวใหม่ๆให้เล่นแบบไม่จำเจ เลือกเล่นได้ไม่ยั้ง คัดสรรแต่สิ่งดีๆมาเสิร์ฟถึงจอมือถือผู้เล่นทุกคน บอกเลยว่าที่นี่ สล็อตแตกง่ายที่สุด ไม่ต้องโหลดแอพให้ขวางสมาร์ทโฟน ก็สามารถเข้าเล่นผ่านหน้าเว็บไซต์ของเราได้ทันที เว็บไซต์ สล็อตแตกง่าย พร้อมจะพาผู้เล่นไปเปิดโลกใบใหม่ที่ต่างไปจากเดิม รับประกันเลยว่าที่นี่ แจ็คพอตแตกง่ายหลายเท่า

ขอขอบคุณreference แจกเครดิตฟรี

เป็นยังไงบ้างครับกับ โปรโมชั่นต่างๆของทาง พุชชี่888 อย่างที่ผมบอกไป คนใดที่เป็นแฟนค่ายเกมพุชชี่888 ไม่ต้องลังเลแล้วครับผม เว็บไซต์ของพวกเรารองรับความต้องการของคุณได้แน่นอน รวมทั้งในบทความหน้า ผมจะมาเล่าอะไรให้ท่านฟังอีก ก็รอคอยติดตามกันด้วยนะครับ สำหรับวันนี้ ผมจำเป็นต้องขอตัวลาไปก่อน แล้วพบกันใหม่ในบทความหน้า

เป็นยังไงบ้างครับกับ โปรโมชั่นต่างๆของทาง พุชชี่888 อย่างที่ผมบอกไป คนใดที่เป็นแฟนค่ายเกมพุชชี่888 ไม่ต้องลังเลแล้วครับผม เว็บไซต์ของพวกเรารองรับความต้องการของคุณได้แน่นอน รวมทั้งในบทความหน้า ผมจะมาเล่าอะไรให้ท่านฟังอีก ก็รอคอยติดตามกันด้วยนะครับ สำหรับวันนี้ ผมจำเป็นต้องขอตัวลาไปก่อน แล้วพบกันใหม่ในบทความหน้า ขอขอบคุณมากby

ขอขอบคุณมากby

สวัสดีครับชาว 918VIP ทุกคน ได้เซฟ สมัคร918kiss ไว้รึยังครับ? ฮ่า… ผมยังคลุมเคลือว่าทุกท่านยังเห็น URL ปาก

สวัสดีครับชาว 918VIP ทุกคน ได้เซฟ สมัคร918kiss ไว้รึยังครับ? ฮ่า… ผมยังคลุมเคลือว่าทุกท่านยังเห็น URL ปาก

เว็บตรง เงินดี สล็อตเว็บตรง M.hengjing168.win 11 มีนา 2023 Wilfredo เจ้าสล็อต168 สล็อตคาสิโนgame 168 Top 8

เว็บตรง เงินดี สล็อตเว็บตรง M.hengjing168.win 11 มีนา 2023 Wilfredo เจ้าสล็อต168 สล็อตคาสิโนgame 168 Top 8.png)

หนังตลก หนังออนไลน์ 2566 movieskub.com 13 April 66 Jessica สารคดี หนังออนไลน์ 2566หนังบู๊ Top 71

หนังตลก หนังออนไลน์ 2566 movieskub.com 13 April 66 Jessica สารคดี หนังออนไลน์ 2566หนังบู๊ Top 71

ในยุคที่เทคโนโลยีเริ่มเข้ามามีหน้าที่มากขึ้นเรื่อยๆในชีวิตประจำวันของเรานั้น ความสะดวกสบาย ความรวดเร็ว และก็ความล้ำยุคต่างๆก็มีเยอะขึ้น ทำให้เทคโนโลยีหรือนวัตกรรมเก่าๆอะไรบางอย่างนั้นถูกแทนที่ ปรับปรุง หรือสูญหายไปเลยก็ว่าได้ครับ ดังเช่นว่า การเข้ามาของแฟลชไดรฟ์ที่ทดแทนฟลอปปี้ดิสก์หรือที่พวกเราเรียกกันอย่างเคยปากว่า แผ่นดิสก์

ในยุคที่เทคโนโลยีเริ่มเข้ามามีหน้าที่มากขึ้นเรื่อยๆในชีวิตประจำวันของเรานั้น ความสะดวกสบาย ความรวดเร็ว และก็ความล้ำยุคต่างๆก็มีเยอะขึ้น ทำให้เทคโนโลยีหรือนวัตกรรมเก่าๆอะไรบางอย่างนั้นถูกแทนที่ ปรับปรุง หรือสูญหายไปเลยก็ว่าได้ครับ ดังเช่นว่า การเข้ามาของแฟลชไดรฟ์ที่ทดแทนฟลอปปี้ดิสก์หรือที่พวกเราเรียกกันอย่างเคยปากว่า แผ่นดิสก์

เล่นเกมสล็อตออนไลน์สุดคลาสสิค จุดเริ่มแรกของความสนุกสนาน

เล่นเกมสล็อตออนไลน์สุดคลาสสิค จุดเริ่มแรกของความสนุกสนาน

2022 เว็บไซต์เด็ด เว็บดัง ปังโครตๆมาที่นี่รวยแน่แค่เล่นบาคาร่า

2022 เว็บไซต์เด็ด เว็บดัง ปังโครตๆมาที่นี่รวยแน่แค่เล่นบาคาร่า

ช่วงนี้มีเว็บไซต์เกมสล็อตเปิดให้เข้าใช้บริการเยอะแยะ ถึงแม้ยังมีนักพนันงงงวยกันจำนวนมากว่า เว็บไซต์สล็อตแตกง่ายที่สุด จะหาเล่นถึงที่กะไว้ไหน พวกเราขอบอกเลยว่าท่านจำเป็นที่จะต้องเข้ามาเล่น เว็บไซต์ให้บริการเกมสล็อตแตกบ่อยกว่าเดิม มีตัวเกมที่น่าเล่นแปลกใหม่กว่าคนใดกันแน่ แถมยังได้มีการอัพเดทระบบเกมใหม่ ยืนยันว่าถ้าเกิดได้เข้าเล่น สล็อตแตกบ่อยครั้ง มากยิ่งกว่าคนใดกันแน่ๆหรือท่านไหนที่อยากได้เข้าเล่นเกมสล็อต พร้อมกับทำรายได้ก้อนโต ยิ่งจำเป็นที่จะต้องเข้ามาเล่นตรงนี้ รับรองว่าได้ผลดีแน่นอนหมุนมัน ปั่นสนุกไปกับ สล็อต โบนัสแตกง่าย การันตีว่าเหมาะสมที่สุด พนันง่าย แจ็คพอตมากมาย พร้อมลุ้นรับทรัพย์สินเงินโตได้ทุกๆวัน

ช่วงนี้มีเว็บไซต์เกมสล็อตเปิดให้เข้าใช้บริการเยอะแยะ ถึงแม้ยังมีนักพนันงงงวยกันจำนวนมากว่า เว็บไซต์สล็อตแตกง่ายที่สุด จะหาเล่นถึงที่กะไว้ไหน พวกเราขอบอกเลยว่าท่านจำเป็นที่จะต้องเข้ามาเล่น เว็บไซต์ให้บริการเกมสล็อตแตกบ่อยกว่าเดิม มีตัวเกมที่น่าเล่นแปลกใหม่กว่าคนใดกันแน่ แถมยังได้มีการอัพเดทระบบเกมใหม่ ยืนยันว่าถ้าเกิดได้เข้าเล่น สล็อตแตกบ่อยครั้ง มากยิ่งกว่าคนใดกันแน่ๆหรือท่านไหนที่อยากได้เข้าเล่นเกมสล็อต พร้อมกับทำรายได้ก้อนโต ยิ่งจำเป็นที่จะต้องเข้ามาเล่นตรงนี้ รับรองว่าได้ผลดีแน่นอนหมุนมัน ปั่นสนุกไปกับ สล็อต โบนัสแตกง่าย การันตีว่าเหมาะสมที่สุด พนันง่าย แจ็คพอตมากมาย พร้อมลุ้นรับทรัพย์สินเงินโตได้ทุกๆวัน เกมยอดนิยมจากค่ายชั้นยอด ที่มาแรงที่สุด 2022 แจ็คพอตแตกบ่อยครั้ง มีทุนสำหรับการลงพนันต่ำ ก็สามารถทำเงินได้แบบสบายๆแถมยังมีระบบระเบียบเกมใหม่ที่น่าเล่น และแตกบ่อยมากกว่าเดิม ที่สำคัญยังเป็นเกมที่ยิงมาจาก เว็บไซต์ตรงไม่ผ่านเอเย่นต์ เข้าเล่นได้แบบไม่มีอันตราย หายห่วง สามารถลงทุนได้แบบไม่มีอย่างต่ำ มีโบนัสแจ็คพอตในเกมที่แจกจริงแจกหนัก เล่นได้เท่าใด ถอนได้เท่านั้น ไม่กำจัด ใครกันแน่ที่อยากได้เข้ามาเล่นเกม สล็อต โบนัสแตกง่าย สามารถเข้ามาเล่นได้เลย พร้อมให้บริการโดย เว็บไซต์สล็อตแตกง่าย ชั้น 1

เกมยอดนิยมจากค่ายชั้นยอด ที่มาแรงที่สุด 2022 แจ็คพอตแตกบ่อยครั้ง มีทุนสำหรับการลงพนันต่ำ ก็สามารถทำเงินได้แบบสบายๆแถมยังมีระบบระเบียบเกมใหม่ที่น่าเล่น และแตกบ่อยมากกว่าเดิม ที่สำคัญยังเป็นเกมที่ยิงมาจาก เว็บไซต์ตรงไม่ผ่านเอเย่นต์ เข้าเล่นได้แบบไม่มีอันตราย หายห่วง สามารถลงทุนได้แบบไม่มีอย่างต่ำ มีโบนัสแจ็คพอตในเกมที่แจกจริงแจกหนัก เล่นได้เท่าใด ถอนได้เท่านั้น ไม่กำจัด ใครกันแน่ที่อยากได้เข้ามาเล่นเกม สล็อต โบนัสแตกง่าย สามารถเข้ามาเล่นได้เลย พร้อมให้บริการโดย เว็บไซต์สล็อตแตกง่าย ชั้น 1 ยังมีข้อดีต่างๆที่ผูกหัวใจผู้เล่น ไม่ว่าใครจะเล่นกับเว็บพวกเรา ก็ต่างพี่จะพอใจกลับมาเล่นซ้ำ ถ้าคนใดยังมิได้เป็นพวกกับ เว็บไซต์สล็อตแตกง่าย แจกจริง ก็สามารถสมัครได้ตามขั้นตอนที่พวกเราแนะนำเลย พร้อมรับเครดิตฟรีในทันที ไม่ต้องทำยอดเทิร์น สามารถถอนได้จริง สล็อตแตกง่าย ทุนน้อย เดี๋ยวนี้ เปิดกว้างให้ทุกคนสามารถทำเงินอาชีพเสริมก็ได้จริงๆโดยที่ไม่มีคดโกง ไม่มีกั๊ก ไม่มีคดโกง

ยังมีข้อดีต่างๆที่ผูกหัวใจผู้เล่น ไม่ว่าใครจะเล่นกับเว็บพวกเรา ก็ต่างพี่จะพอใจกลับมาเล่นซ้ำ ถ้าคนใดยังมิได้เป็นพวกกับ เว็บไซต์สล็อตแตกง่าย แจกจริง ก็สามารถสมัครได้ตามขั้นตอนที่พวกเราแนะนำเลย พร้อมรับเครดิตฟรีในทันที ไม่ต้องทำยอดเทิร์น สามารถถอนได้จริง สล็อตแตกง่าย ทุนน้อย เดี๋ยวนี้ เปิดกว้างให้ทุกคนสามารถทำเงินอาชีพเสริมก็ได้จริงๆโดยที่ไม่มีคดโกง ไม่มีกั๊ก ไม่มีคดโกง เว็บ

เว็บ ผู้คนจำนวนมากมีความคิดเห็นว่าเป็นเกมการพนันที่ไม่ถูกกฎหมายในประเทศไทย จนถึงคิดอคติไปกับมันเลย บางบุคคลอคติมากเกินกระทั่งแลเห็นคนที่อยู่รอบข้างเล่น เว็บบาคาร่า ก็อาจจะระรานรังเกียจผู้ที่เล่นไปด้วย ซึ่งถ้าหากว่าถามว่าคนที่อคติผิดไหม คำตอบเป็นไม่ แล้วหลังจากนั้นก็แม้ถามคำถามว่าคิดที่เล่นการเดิมพันผิดไหม คำตอบก็คือไม่เหมือนกัน ด้วยความที่มันเป็นความถูกใจส่วนตัว ผู้ที่เล่นการเดิมพันก็มิได้ทำให้คนไหนกันแน่เดือดรร้อน มหาศาลก็ตกระกำลำบากตัวเอง โดยเหตุนั้น พวกเราควรจะนับถือสิทธิของแต่ละคนดีมากกว่า

ผู้คนจำนวนมากมีความคิดเห็นว่าเป็นเกมการพนันที่ไม่ถูกกฎหมายในประเทศไทย จนถึงคิดอคติไปกับมันเลย บางบุคคลอคติมากเกินกระทั่งแลเห็นคนที่อยู่รอบข้างเล่น เว็บบาคาร่า ก็อาจจะระรานรังเกียจผู้ที่เล่นไปด้วย ซึ่งถ้าหากว่าถามว่าคนที่อคติผิดไหม คำตอบเป็นไม่ แล้วหลังจากนั้นก็แม้ถามคำถามว่าคิดที่เล่นการเดิมพันผิดไหม คำตอบก็คือไม่เหมือนกัน ด้วยความที่มันเป็นความถูกใจส่วนตัว ผู้ที่เล่นการเดิมพันก็มิได้ทำให้คนไหนกันแน่เดือดรร้อน มหาศาลก็ตกระกำลำบากตัวเอง โดยเหตุนั้น พวกเราควรจะนับถือสิทธิของแต่ละคนดีมากกว่า ขอขอบคุณby

ขอขอบคุณby

มองหาสล็อตเว็บตรง มองหา PG SLOT pg slot เว็บตรงแท้ 100% ฝากถอนออโต้ สมัครเลย!

มองหาสล็อตเว็บตรง มองหา PG SLOT pg slot เว็บตรงแท้ 100% ฝากถอนออโต้ สมัครเลย! คุณไม่สามารถที่จะหาประสบการณ์การเล่นสล็อตออนไลน์ที่ดีไปกว่านี้ได้แล้วล่ะครับผม และยิ่งถ้าคุณเป็นแฟนทางเข้าPG เหมือนกับผม ที่นี่ล่ะครับตอบบโจทย์สุดๆทางเข้ามีนานัปการหนทาง ตอบปัญหาทุกความต้องการของทุกคนได้แน่นอน ไม่ว่าคุณจะเป็นนักเล่นสล็อตผู้ชำนาญ มือใหม่ สายทุนหนา หรือแม้กระทั้งสายทุนน้อย ก็สามารถมาใช้บริการกับเราได้เลย ลงทะเบียนสมัครสมาชิกแล้วมาจอยกันครับ!

คุณไม่สามารถที่จะหาประสบการณ์การเล่นสล็อตออนไลน์ที่ดีไปกว่านี้ได้แล้วล่ะครับผม และยิ่งถ้าคุณเป็นแฟนทางเข้าPG เหมือนกับผม ที่นี่ล่ะครับตอบบโจทย์สุดๆทางเข้ามีนานัปการหนทาง ตอบปัญหาทุกความต้องการของทุกคนได้แน่นอน ไม่ว่าคุณจะเป็นนักเล่นสล็อตผู้ชำนาญ มือใหม่ สายทุนหนา หรือแม้กระทั้งสายทุนน้อย ก็สามารถมาใช้บริการกับเราได้เลย ลงทะเบียนสมัครสมาชิกแล้วมาจอยกันครับ! • เข้าผ่านคอมพิวเตอร์ โน้ตบุ๊ก หรือแท็ปเล็ตได้

• เข้าผ่านคอมพิวเตอร์ โน้ตบุ๊ก หรือแท็ปเล็ตได้ 1. เลือกเว็บสล็อตชั้น1 เป็นสล็อตเว็บไซต์ตรงเพียงแค่นั้น

1. เลือกเว็บสล็อตชั้น1 เป็นสล็อตเว็บไซต์ตรงเพียงแค่นั้น 3. มีค่ายเกมที่เราต้องการเล่นไหม

3. มีค่ายเกมที่เราต้องการเล่นไหม ขอขอบคุณby web

ขอขอบคุณby web

ก็ต้องบอกเลยจ้าครับว่า ในตอนนี้ ใครกันแน่ที่ยังไม่ได้ใช้บริการของสล็อตเว็บตรงล่ะก็ จัดว่าคุณกำลังพลาดมากมายๆครับผม! เพราะว่าในปัจจุบัน การใช้บริการของสล็อตเว็บตรงเป็นที่นิยมอย่างมาก ซึ่งเรา PG SLOT เป็นสล็อตแตกง่ายที่เป็นเว็บตรง ได้รับการรับรองจากบริษัทแม่ในเมืองนอกอย่างถูกต้อง มีความน่าไว้วางใจและความปลอดภัยสูง หากคุณมาใช้บริการเว็บของเรา คุณจะสบายใจได้เลยขอรับว่า จะผิดคดโกงหรือถูกบิดแน่นอน พวกเราเป็นเว็บไซต์สล็อตเว็บใหญ่ที่จ่ายหนักจ่ายจริง

ก็ต้องบอกเลยจ้าครับว่า ในตอนนี้ ใครกันแน่ที่ยังไม่ได้ใช้บริการของสล็อตเว็บตรงล่ะก็ จัดว่าคุณกำลังพลาดมากมายๆครับผม! เพราะว่าในปัจจุบัน การใช้บริการของสล็อตเว็บตรงเป็นที่นิยมอย่างมาก ซึ่งเรา PG SLOT เป็นสล็อตแตกง่ายที่เป็นเว็บตรง ได้รับการรับรองจากบริษัทแม่ในเมืองนอกอย่างถูกต้อง มีความน่าไว้วางใจและความปลอดภัยสูง หากคุณมาใช้บริการเว็บของเรา คุณจะสบายใจได้เลยขอรับว่า จะผิดคดโกงหรือถูกบิดแน่นอน พวกเราเป็นเว็บไซต์สล็อตเว็บใหญ่ที่จ่ายหนักจ่ายจริง ส่งต่อโปรโมชั่นดีๆจากเว็บไซต์สล็อตอันดับ 1 ในเอเชีย

ส่งต่อโปรโมชั่นดีๆจากเว็บไซต์สล็อตอันดับ 1 ในเอเชีย

Jubyet69 เว็บ ดูหนังx ออนไลน์ มากที่สุดในเอเชีย หนัง 18 ฟรี สะสมเหล่าดาราตัวท็อปไว้ทั้งสิ้น มีทุกต้นแบบ ไม่ว่าจะเป็น หนังหนังเอ็กซ์69 หนัง69 หนัง 18 ฟรี บอกเลยว่าของแท้จัดๆJubyet69 สำหรับทุกเพศทุกวัย หนังอาร์69 ก็มีให้ได้ลองมาตำกันแบบนับไม่ถ้วน อีกทั้ง ดูหนังx ผู้เรียน หนัง69 นักศึกษา หนังเอ็กซ์69 บริษัทจัดหาคู่ รวมไปถึงงาน onlyfans หนัง 18 ฟรี บอกเลยว่า หนังโป๊69 หนัง69 ของดี หนัง 18 ฟรี แบบงี้ Jubyet69 ดูได้ที่นี่ที่เดียว แถมอัพเดทวันแล้ววันเล่าเกือบจะทุกเวลา ของใหม่มาใหม่ Jubyet69 จัดให้หมด แตกแล้วแตกอีก แตกจนกระทั่งปวดมือปวดแขนกันไปหมดแล้ววว

Jubyet69 เว็บ ดูหนังx ออนไลน์ มากที่สุดในเอเชีย หนัง 18 ฟรี สะสมเหล่าดาราตัวท็อปไว้ทั้งสิ้น มีทุกต้นแบบ ไม่ว่าจะเป็น หนังหนังเอ็กซ์69 หนัง69 หนัง 18 ฟรี บอกเลยว่าของแท้จัดๆJubyet69 สำหรับทุกเพศทุกวัย หนังอาร์69 ก็มีให้ได้ลองมาตำกันแบบนับไม่ถ้วน อีกทั้ง ดูหนังx ผู้เรียน หนัง69 นักศึกษา หนังเอ็กซ์69 บริษัทจัดหาคู่ รวมไปถึงงาน onlyfans หนัง 18 ฟรี บอกเลยว่า หนังโป๊69 หนัง69 ของดี หนัง 18 ฟรี แบบงี้ Jubyet69 ดูได้ที่นี่ที่เดียว แถมอัพเดทวันแล้ววันเล่าเกือบจะทุกเวลา ของใหม่มาใหม่ Jubyet69 จัดให้หมด แตกแล้วแตกอีก แตกจนกระทั่งปวดมือปวดแขนกันไปหมดแล้ววว Jubyet69 หนัง 18 ฟรี เว็บไซต์ ดูหนังx หนัง 18 ฟรี หนังโป๊69 24ชั่วโมง เพราะอะไรถึงมาแรงที่สุด น่าดูที่สุดในช่วงเวลานี้?

Jubyet69 หนัง 18 ฟรี เว็บไซต์ ดูหนังx หนัง 18 ฟรี หนังโป๊69 24ชั่วโมง เพราะอะไรถึงมาแรงที่สุด น่าดูที่สุดในช่วงเวลานี้?

ดาวน์โหลด สล็อตออนไลน์สล็อต888แตกง่ายเว็บพนันออนไลน์ สล็อต แตกหนัก https://www.jinda888.vip/ 2 Mar 2566 Dario เกมสล็อต888 เว็บตรงฝากถอนไม่มีขั้นต่ำ Top 46

ดาวน์โหลด สล็อตออนไลน์สล็อต888แตกง่ายเว็บพนันออนไลน์ สล็อต แตกหนัก https://www.jinda888.vip/ 2 Mar 2566 Dario เกมสล็อต888 เว็บตรงฝากถอนไม่มีขั้นต่ำ Top 46 ขอขอบพระคุณที่มา

ขอขอบพระคุณที่มา

ทุนหลักร้อยถอนหลักหมื่น เล่นเกม PG มีเเต่ได้ ไม่มีเสีย

ทุนหลักร้อยถอนหลักหมื่น เล่นเกม PG มีเเต่ได้ ไม่มีเสีย เว็บ สล็อต แจกทุน ฟรี 2022 เข้าทุกๆวัน ร่ำรวยแต่ละวัน

เว็บ สล็อต แจกทุน ฟรี 2022 เข้าทุกๆวัน ร่ำรวยแต่ละวัน กดรับ โปรทุนน้อย เล่นอย่างต่ำเเค่ 1 บาท ถึงที่กะไว้นี่เท่านั้น

กดรับ โปรทุนน้อย เล่นอย่างต่ำเเค่ 1 บาท ถึงที่กะไว้นี่เท่านั้น

ขั้นตอนลงทะเบียนเล่นสล็อตออนไลน์ง่ายภายใน 3 นาที

ขั้นตอนลงทะเบียนเล่นสล็อตออนไลน์ง่ายภายใน 3 นาที

3.ดูหนังหนังออนไลน์ดูหนังออนไลน์ กับเรา มีหมวดและวัสดุค้นหาหนังที่ล้ำสมัยที่สุด เพื่อลูกค้าทุกท่าน สามารถตามหาหนังที่ต้องการมองได้ หมู่เราไม่ได้ใช้ AI ในการจัด พวกเรา movie2k รู้เรื่องว่าการเข้าหมวดหมู่นึงแล้วมีหนังของอีกหมู่นึงอยู่มันไม่น่าสนใจแค่ไหน พวกเราก็เลยต้องทำการแยกประเภทด้วยตัวเองอยู่เสมอเวลามีหนังใหม่เข้ามา แถมอีกอย่างคือ อุปกรณ์ค้นหาของเรา เป็นระบบค้นหาที่นำสมัยที่สุด ทุกคนสามารถพิมคีย์เวิร์ดของหนังที่ทุกคนต้องการจะดูได้เลย แล้วมันจะสร้างหมวดหมู่ที่มีความเหมือนกับคีย์เวิร์ดที่ทุกท่านเขียนลงไป บอกเลย เว็บอื่นค้นหาอะไรไม่เคยจะเจอ เพราะเหตุว่ามันเป็นตัวค้นหาแบบเก่าไงเล่า!

3.ดูหนังหนังออนไลน์ดูหนังออนไลน์ กับเรา มีหมวดและวัสดุค้นหาหนังที่ล้ำสมัยที่สุด เพื่อลูกค้าทุกท่าน สามารถตามหาหนังที่ต้องการมองได้ หมู่เราไม่ได้ใช้ AI ในการจัด พวกเรา movie2k รู้เรื่องว่าการเข้าหมวดหมู่นึงแล้วมีหนังของอีกหมู่นึงอยู่มันไม่น่าสนใจแค่ไหน พวกเราก็เลยต้องทำการแยกประเภทด้วยตัวเองอยู่เสมอเวลามีหนังใหม่เข้ามา แถมอีกอย่างคือ อุปกรณ์ค้นหาของเรา เป็นระบบค้นหาที่นำสมัยที่สุด ทุกคนสามารถพิมคีย์เวิร์ดของหนังที่ทุกคนต้องการจะดูได้เลย แล้วมันจะสร้างหมวดหมู่ที่มีความเหมือนกับคีย์เวิร์ดที่ทุกท่านเขียนลงไป บอกเลย เว็บอื่นค้นหาอะไรไม่เคยจะเจอ เพราะเหตุว่ามันเป็นตัวค้นหาแบบเก่าไงเล่า!

การล่นเกมบาคาร่าออนไลน์กับ บาคาร่า168 บาคาร่า168 เว็บขนาดใหญ่ที่รองรับการเข้าใช้งานมากที่สุดในประเทศไทย การเดิมพันเกมบาคาร่าออนไลน์บนเว็บไซต์แห่งนี้ ความ ค้ำประกันความคุ้มค่า สำหรับผู้เล่นใหม่หรือเก่า ก็ สามารถรับโปรโมชั่นที่ดีเยี่ยมที่สุดกับพวกเราได้สิ่งเดียวกัน เนื่องจากว่าพวกเราเป็นเว็บไซต์ที่มีมาตรฐานระดับสากล ที่มีขนาดใหญ่เยอะที่สุดในประเทศไทย บาคาร่าออนไลน์ แล้วก็ต่างแดน แถมยังนายทุนจำนวนมากจากทั่วโลกที่ เตรียมตัวคอยซัพพอร์ต ให้ลูกค้าที่เข้ามาเล่นเกม

การล่นเกมบาคาร่าออนไลน์กับ บาคาร่า168 บาคาร่า168 เว็บขนาดใหญ่ที่รองรับการเข้าใช้งานมากที่สุดในประเทศไทย การเดิมพันเกมบาคาร่าออนไลน์บนเว็บไซต์แห่งนี้ ความ ค้ำประกันความคุ้มค่า สำหรับผู้เล่นใหม่หรือเก่า ก็ สามารถรับโปรโมชั่นที่ดีเยี่ยมที่สุดกับพวกเราได้สิ่งเดียวกัน เนื่องจากว่าพวกเราเป็นเว็บไซต์ที่มีมาตรฐานระดับสากล ที่มีขนาดใหญ่เยอะที่สุดในประเทศไทย บาคาร่าออนไลน์ แล้วก็ต่างแดน แถมยังนายทุนจำนวนมากจากทั่วโลกที่ เตรียมตัวคอยซัพพอร์ต ให้ลูกค้าที่เข้ามาเล่นเกม

Slotxo24hr

Slotxo24hr  การเล่นสล็อตออนไลน์อาจเป็นประสบการณ์ที่บันเทิงใจรวมทั้งน่าระทึกใจ แม้กระนั้นการชนะบางทีอาจเกิดเรื่องที่ท้าทายนิดหน่อย แม้กระนั้น มีกลเม็ดและก็กลอุบายบางสิ่งที่คุณสามารถใช้เพื่อเพิ่มโอกาสในการชนะบนแพลตฟอร์ม Slotxo ของเรา ทำไมและก็อย่างไรบ้าง ไปดูกัน!

การเล่นสล็อตออนไลน์อาจเป็นประสบการณ์ที่บันเทิงใจรวมทั้งน่าระทึกใจ แม้กระนั้นการชนะบางทีอาจเกิดเรื่องที่ท้าทายนิดหน่อย แม้กระนั้น มีกลเม็ดและก็กลอุบายบางสิ่งที่คุณสามารถใช้เพื่อเพิ่มโอกาสในการชนะบนแพลตฟอร์ม Slotxo ของเรา ทำไมและก็อย่างไรบ้าง ไปดูกัน! M.slotxo24hr สล็อตxoเว็บตรง M.slotxo24hr.co 16 เม.ย. 23 Darcy เว็บสล็อตตรงไม่ผ่านเอเย่นต์ slotxoสล็อต xo เวอร์ชั่นใหม่ Top 61

M.slotxo24hr สล็อตxoเว็บตรง M.slotxo24hr.co 16 เม.ย. 23 Darcy เว็บสล็อตตรงไม่ผ่านเอเย่นต์ slotxoสล็อต xo เวอร์ชั่นใหม่ Top 61

ลู่ทางสำหรับคนที่พึงพอใจจะหาเกมสล็อตแตกดี รวมครบทุกค่ายดัง แหล่งรวมชั้นแนวหน้า ระบบการใช้งานได้มาตรฐานดี แจกสิทธิพิเศษฟรีไม่ยั้ง หลายรายการทุกเมื่อเชื่อวัน ฝากถอนผ่านระบบอัติโนมัติเตียน ไม่มีขั้นต่ำ มีทุนน้อย ก็สามารถเข้ามาเลือกลงทุนเดิมพันได้ เกมสล็อตแตกง่ายกับพวกเราได้ทุกรูปแบบตามอยาก การันตีระบบเกมโปร่งใส ไม่มีการล็อกยูส ทำกำไรได้เงินจริง เข้ามาเลือกเล่น สล็อตออนไลน์ pgslot-1st กดรับเครดิตฟรี ได้ไม่จำกัดทุกๆวัน ตัวช่วยทำเงินดีๆพวกเรามีให้ทุกท่านเลือกใช้แบบไม่จำกัด เล่นได้พวกเราจ่ายจริงได้จริง ร่ำรวยขึ้นได้ก่อนคนใดกัน แค่เพียงตัดสินใจเข้ามาเปิดยูส เป็นพวกใหม่กับพวกเราได้แล้ววันนี้ สล็อต

ลู่ทางสำหรับคนที่พึงพอใจจะหาเกมสล็อตแตกดี รวมครบทุกค่ายดัง แหล่งรวมชั้นแนวหน้า ระบบการใช้งานได้มาตรฐานดี แจกสิทธิพิเศษฟรีไม่ยั้ง หลายรายการทุกเมื่อเชื่อวัน ฝากถอนผ่านระบบอัติโนมัติเตียน ไม่มีขั้นต่ำ มีทุนน้อย ก็สามารถเข้ามาเลือกลงทุนเดิมพันได้ เกมสล็อตแตกง่ายกับพวกเราได้ทุกรูปแบบตามอยาก การันตีระบบเกมโปร่งใส ไม่มีการล็อกยูส ทำกำไรได้เงินจริง เข้ามาเลือกเล่น สล็อตออนไลน์ pgslot-1st กดรับเครดิตฟรี ได้ไม่จำกัดทุกๆวัน ตัวช่วยทำเงินดีๆพวกเรามีให้ทุกท่านเลือกใช้แบบไม่จำกัด เล่นได้พวกเราจ่ายจริงได้จริง ร่ำรวยขึ้นได้ก่อนคนใดกัน แค่เพียงตัดสินใจเข้ามาเปิดยูส เป็นพวกใหม่กับพวกเราได้แล้ววันนี้ สล็อต

มาดูหนัง GDH ที่ madoohd.com กันเถิด EP.1

มาดูหนัง GDH ที่ madoohd.com กันเถิด EP.1 สวัสดีขอรับชาว ดูหนัง ทุกคน เป็นยังไงบ้างขอรับ ในช่วงวันหยุดสุดสัปดาห์อย่างงี้ ท่องเที่ยวไหนกัน

สวัสดีขอรับชาว ดูหนัง ทุกคน เป็นยังไงบ้างขอรับ ในช่วงวันหยุดสุดสัปดาห์อย่างงี้ ท่องเที่ยวไหนกัน

เพราะเหตุไรเกมสล็อตpgแท้ pg168 ถึงมีความนิยมในตอนนี้

เพราะเหตุไรเกมสล็อตpgแท้ pg168 ถึงมีความนิยมในตอนนี้ pg มีธีมสล็อตอะไรบ้าง pg

pg มีธีมสล็อตอะไรบ้าง pg ทางเว็บจะมีโปรโมชันต้อนรับสมาชิกใหม่ โดยจะมอบให้กับสมาชิกทุกท่านที่พึ่งจะสมัครเข้ามา ซึ่งจะเป็นรูปแบบของโบนัสจำนวนหนึ่ง ซึ่งจะนำไปใช้เล่นเกมได้ในทันทีโดยไม่ต้องฝากเงินเข้าระบบก่อน โดยจำเป็นต้องทำยอดเทิร์นให้ได้พอๆกับยอดฝากก็สามารถจะเบิกเงินออกมาได้ อีกรูปแบบของการรับโบนัสพิเศษก็คือ จำเป็นต้องฝากเงินเข้าระบบจำนวนหนึ่งหรือฝากเงินเริ่มต้น โดยจะได้รับโบนัสตั้งแต่ 10% ขึ้นไปเพื่อจะนำไปใช้สำหรับการเล่นเกม ก็จะได้รับโบนัสพิเศษมากขึ้นอีก โดยในทุกวันผู้เล่นควรต้องนำไปใช้เล่นเกมให้ได้ก็จะถอนเงินสดออกมาได้โดยทันที

ทางเว็บจะมีโปรโมชันต้อนรับสมาชิกใหม่ โดยจะมอบให้กับสมาชิกทุกท่านที่พึ่งจะสมัครเข้ามา ซึ่งจะเป็นรูปแบบของโบนัสจำนวนหนึ่ง ซึ่งจะนำไปใช้เล่นเกมได้ในทันทีโดยไม่ต้องฝากเงินเข้าระบบก่อน โดยจำเป็นต้องทำยอดเทิร์นให้ได้พอๆกับยอดฝากก็สามารถจะเบิกเงินออกมาได้ อีกรูปแบบของการรับโบนัสพิเศษก็คือ จำเป็นต้องฝากเงินเข้าระบบจำนวนหนึ่งหรือฝากเงินเริ่มต้น โดยจะได้รับโบนัสตั้งแต่ 10% ขึ้นไปเพื่อจะนำไปใช้สำหรับการเล่นเกม ก็จะได้รับโบนัสพิเศษมากขึ้นอีก โดยในทุกวันผู้เล่นควรต้องนำไปใช้เล่นเกมให้ได้ก็จะถอนเงินสดออกมาได้โดยทันที

ระบบ ทดสอบเล่นสล็อต PG เว็บตรง เปิดให้บริการแล้วในประเทศไทย!

ระบบ ทดสอบเล่นสล็อต PG เว็บตรง เปิดให้บริการแล้วในประเทศไทย! ระบบ ทดลองเล่นทดลองเล่นสล็อต PG เว็บตรง ของพวกเรา เป็นเยี่ยมในระบบชั้นยอดของค่ายสล็อตพีจีในปัจจุบัน เนื่องจากว่าพวกเราเชื่อว่า เงินขณะนี้มันหายาก ใครๆก็อย่างได้เงินกล้วยๆจริงไหม? ด้วยเหตุผลดังกล่าว การที่ค่ายสล็อตออนไลน์ชื่อดับสุดยอดอย่าง pg มาเปิดให้บริการ ทดลองเล่นสล็อต pg นั้น มันคือการสร้างจังหวะรวมทั้งเพิ่มผลตอบแทนหรือจำนวนผู้รับบริการเป็นอย่างมาก เนื่องจากว่าเพราะเหตุว่าเงินหายาก แม้กระนั้นคนก็ยังเข้ามาเล่นสล็อตออนไลน์กัน โดยเหตุนั้นเราก็เลยตั้งอกตั้งใจที่จะให้ทุกท่านได้ ทดลองเล่นสล็อต PG เว็บไซต์ตรง ของพวกเราดูซิ จะเรียกว่าเป็นการสร้างความมั่นใจและความเชื่อมั่นหรือเป็นการเช็คดวงอะไรก็ได้ ทำให้ลูกค้าทุกท่านมีความแน่ใจสำหรับเพื่อการเล่นสล็อตออนไลน์กับเว็บของพวกเรามากยิ่งขึ้นนั่นเองแรง

ระบบ ทดลองเล่นทดลองเล่นสล็อต PG เว็บตรง ของพวกเรา เป็นเยี่ยมในระบบชั้นยอดของค่ายสล็อตพีจีในปัจจุบัน เนื่องจากว่าพวกเราเชื่อว่า เงินขณะนี้มันหายาก ใครๆก็อย่างได้เงินกล้วยๆจริงไหม? ด้วยเหตุผลดังกล่าว การที่ค่ายสล็อตออนไลน์ชื่อดับสุดยอดอย่าง pg มาเปิดให้บริการ ทดลองเล่นสล็อต pg นั้น มันคือการสร้างจังหวะรวมทั้งเพิ่มผลตอบแทนหรือจำนวนผู้รับบริการเป็นอย่างมาก เนื่องจากว่าเพราะเหตุว่าเงินหายาก แม้กระนั้นคนก็ยังเข้ามาเล่นสล็อตออนไลน์กัน โดยเหตุนั้นเราก็เลยตั้งอกตั้งใจที่จะให้ทุกท่านได้ ทดลองเล่นสล็อต PG เว็บไซต์ตรง ของพวกเราดูซิ จะเรียกว่าเป็นการสร้างความมั่นใจและความเชื่อมั่นหรือเป็นการเช็คดวงอะไรก็ได้ ทำให้ลูกค้าทุกท่านมีความแน่ใจสำหรับเพื่อการเล่นสล็อตออนไลน์กับเว็บของพวกเรามากยิ่งขึ้นนั่นเองแรง

อย่างที่ผมได้บอกไปเลยจ๊าครับผม ความเป็น สล็อต pg เว็บไซต์ตรง แตกหนัก นั้นจะยืนยันโปรโมชั่นแล้วก็กิจกรรมแบบจัดเต็มแน่นอนขอรับ ซึ่ง สล็อต PG เว็บตรง แตกหนัก ก็จัดเต็มกับหัวข้อนี้ไม่แพ้กัน เนื่องจากว่าเราเป็นสมาชิกใหม่ไฟแรง สมาชิกของพวกเราบางครั้งก็อาจจะไม่ได้มากมายนัก แต่ว่าก็หลัก 100,000 คนเลยล่ะครับ บอกเลยว่า ถ้าคุณลงทะเบียนและมาใช้บริการกับพวกเราล่ะก็ จะได้รับสิทธิพิเศษและความสนุกสนานร่าเริงแบบจัดเต็มแน่นอน ซึ่งโปรโมชั่นรวมทั้งกิจกรรมของเรา pg slot เว็บไซต์ตรงจะมีอะไรบ้างนั้น มาดูกันเลยนะครับ!

อย่างที่ผมได้บอกไปเลยจ๊าครับผม ความเป็น สล็อต pg เว็บไซต์ตรง แตกหนัก นั้นจะยืนยันโปรโมชั่นแล้วก็กิจกรรมแบบจัดเต็มแน่นอนขอรับ ซึ่ง สล็อต PG เว็บตรง แตกหนัก ก็จัดเต็มกับหัวข้อนี้ไม่แพ้กัน เนื่องจากว่าเราเป็นสมาชิกใหม่ไฟแรง สมาชิกของพวกเราบางครั้งก็อาจจะไม่ได้มากมายนัก แต่ว่าก็หลัก 100,000 คนเลยล่ะครับ บอกเลยว่า ถ้าคุณลงทะเบียนและมาใช้บริการกับพวกเราล่ะก็ จะได้รับสิทธิพิเศษและความสนุกสนานร่าเริงแบบจัดเต็มแน่นอน ซึ่งโปรโมชั่นรวมทั้งกิจกรรมของเรา pg slot เว็บไซต์ตรงจะมีอะไรบ้างนั้น มาดูกันเลยนะครับ! • กิจกรรม ชักชวนเพื่อนฝูงรับเครดิตฟรี 100 บาท เพียงแต่คุณชวนเพื่อนมาสมัครรวมทั้งฝากแบบรับโบนัสขั้นต่ำ

• กิจกรรม ชักชวนเพื่อนฝูงรับเครดิตฟรี 100 บาท เพียงแต่คุณชวนเพื่อนมาสมัครรวมทั้งฝากแบบรับโบนัสขั้นต่ำ • เล่นเกม pg slot ได้แบบจัดเต็ม เนื่องจากว่าเรา pg slot เว็บตรง เป็น pg slot เว็บตรง ก็ไม่แปลกเลยขอรับที่เกมดังจากค่าย pg slot จะจัดเต็มมากมายๆมีทุกเกม ไม่ว่าจะเกมเก่า เกมใหม่ เกมดัง หรือเกมฮิต เราขนมาครบทุกเกมแน่นอน 100%

• เล่นเกม pg slot ได้แบบจัดเต็ม เนื่องจากว่าเรา pg slot เว็บตรง เป็น pg slot เว็บตรง ก็ไม่แปลกเลยขอรับที่เกมดังจากค่าย pg slot จะจัดเต็มมากมายๆมีทุกเกม ไม่ว่าจะเกมเก่า เกมใหม่ เกมดัง หรือเกมฮิต เราขนมาครบทุกเกมแน่นอน 100%

pg slot pg slotทำความรู้จักเว็บเกมสล็อตเอเชียลีทเกมเมอร์ leetgamers

pg slot pg slotทำความรู้จักเว็บเกมสล็อตเอเชียลีทเกมเมอร์ leetgamers กรรมวิธีการเล่นเกมสล็อตของเราง่ายดายยิ่งกว่าเกมสล็อตทั่วๆไป

กรรมวิธีการเล่นเกมสล็อตของเราง่ายดายยิ่งกว่าเกมสล็อตทั่วๆไป

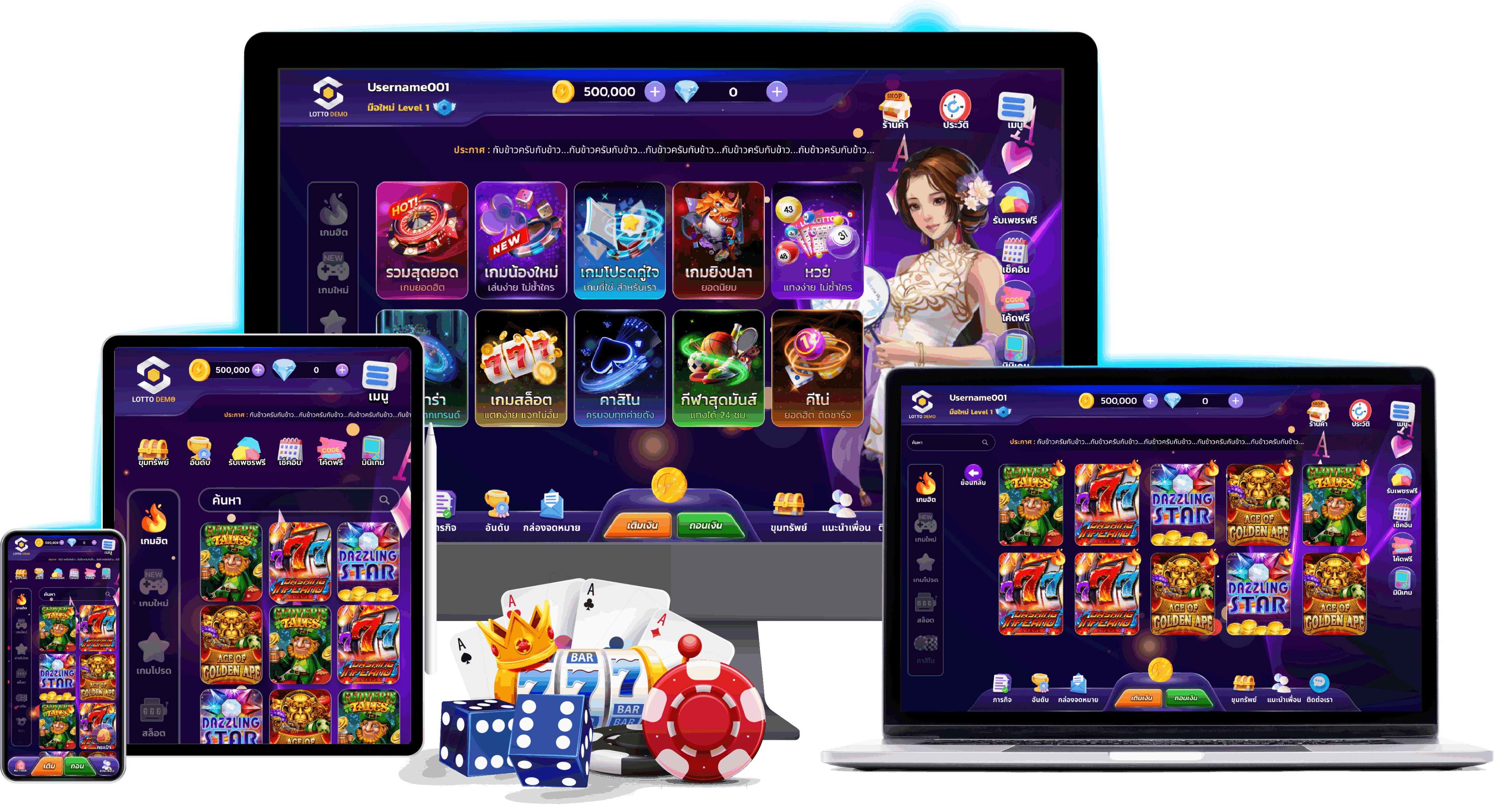

ข้อบกพร่องของลอตโต้ เว็บหวยสด

ข้อบกพร่องของลอตโต้ เว็บหวยสด จังหวะถูกลอตเตอรี่

จังหวะถูกลอตเตอรี่ จังหวะถูกหวยออนไลน์

จังหวะถูกหวยออนไลน์ หวยยี่กี เว็บหวยสด Game.no1huay.com 16 JUL 66 Geoffrey ปลอดภัยกว่าฝากเขาแทง เว็บหวยสดสมัครซื้อหวยได้เลยตอนนี้ Top 41

หวยยี่กี เว็บหวยสด Game.no1huay.com 16 JUL 66 Geoffrey ปลอดภัยกว่าฝากเขาแทง เว็บหวยสดสมัครซื้อหวยได้เลยตอนนี้ Top 41 1. ดูหนังหนังออนไลน์ หน้าหลัก : เป็นหมวดหมู่ที่เราจะสะสมหนังออนไลน์ ทั้งยังใหม่และก็เก่าที่ยอดนิยมหรือคนดูมากตลอดกาลรวมเอาไว้ภายในหน้าหลัก เนื่องจากว่าทุกท่านอาจจะยังไม่รู้เรื่องว่าต้องการดูอะไร ด้วยเหตุดังกล่าว เว็บ ดูหนังผ่านอินเตอร์เน็ต หนังใหม่ ดูหนังออนไลน์ 2023 ของพวกเรา จัดให้ เป็น recommend หนังออนไลน์ที่ห้ามพลาด รวมทั้งมีทุกแบบอย่างทุกชนิดผสมกันอยู่ในหน้าหลักทั้งหมดทั้งปวงเลยนะ สะดวกสบายแบบที่สุด!

1. ดูหนังหนังออนไลน์ หน้าหลัก : เป็นหมวดหมู่ที่เราจะสะสมหนังออนไลน์ ทั้งยังใหม่และก็เก่าที่ยอดนิยมหรือคนดูมากตลอดกาลรวมเอาไว้ภายในหน้าหลัก เนื่องจากว่าทุกท่านอาจจะยังไม่รู้เรื่องว่าต้องการดูอะไร ด้วยเหตุดังกล่าว เว็บ ดูหนังผ่านอินเตอร์เน็ต หนังใหม่ ดูหนังออนไลน์ 2023 ของพวกเรา จัดให้ เป็น recommend หนังออนไลน์ที่ห้ามพลาด รวมทั้งมีทุกแบบอย่างทุกชนิดผสมกันอยู่ในหน้าหลักทั้งหมดทั้งปวงเลยนะ สะดวกสบายแบบที่สุด!

วิธีเล่นสล็อตทีแรก เล่นแบบไหนให้โบนัสแตก แบบไม่ต้องขอคืนดีดวง วันนี้ เว็บมาแรง ที่และคุณภาพpg จะพาคุณไปตรวจกรรมวิธีเล่นฉบับมือใหม่ เป็นวิธีการเล่นที่เข้าใจง่าย

วิธีเล่นสล็อตทีแรก เล่นแบบไหนให้โบนัสแตก แบบไม่ต้องขอคืนดีดวง วันนี้ เว็บมาแรง ที่และคุณภาพpg จะพาคุณไปตรวจกรรมวิธีเล่นฉบับมือใหม่ เป็นวิธีการเล่นที่เข้าใจง่าย  แนวทางเล่นสล็อตคราวแรก ทราบก่อน มั่งคั่งก่อน ไม่ต้องขอคืนดีดวง

แนวทางเล่นสล็อตคราวแรก ทราบก่อน มั่งคั่งก่อน ไม่ต้องขอคืนดีดวง เกม ค่าย 888เว็บ jinda888คาสิโนออนไลน์ สล็อต

เกม ค่าย 888เว็บ jinda888คาสิโนออนไลน์ สล็อต

m.jinda55 slot เครดิตฟรี เว็บตรง มั่นคง ไม่เป็นอันตราย 100 มาทดลองสมัครสมาชิกแล้วไม่จำเป็นต้องกลุ้มใจอะไรเลย ที่จะเพิ่มหนทางได้กำไรได้เป็นอย่างดี แล้วต้องการเสนอแนะให้ทดสอบเข้ามาเล่าเรียนถึงทางที่มองหาเว็บตรงที่มีความปลอดภัย,

m.jinda55 slot เครดิตฟรี เว็บตรง มั่นคง ไม่เป็นอันตราย 100 มาทดลองสมัครสมาชิกแล้วไม่จำเป็นต้องกลุ้มใจอะไรเลย ที่จะเพิ่มหนทางได้กำไรได้เป็นอย่างดี แล้วต้องการเสนอแนะให้ทดสอบเข้ามาเล่าเรียนถึงทางที่มองหาเว็บตรงที่มีความปลอดภัย,  เล่นสล็อตเว็บไซต์ตรงได้เงินจริง มือใหม่ ปั๊มเงินได้ไม่ยาก สล็อตออนไลน์

เล่นสล็อตเว็บไซต์ตรงได้เงินจริง มือใหม่ ปั๊มเงินได้ไม่ยาก สล็อตออนไลน์

Moviekece เว็บไซต์ดูหนังผ่านเน็ตดูหนังออนไลน์ เว็บไซต์ดูหนังฟรี 24 ชั่วโมง

Moviekece เว็บไซต์ดูหนังผ่านเน็ตดูหนังออนไลน์ เว็บไซต์ดูหนังฟรี 24 ชั่วโมง

4. ไม่ต้องจำสูตร pgslot เว็บตรงเยอะแยะ หาสไตล์ให้พบก็พอ

4. ไม่ต้องจำสูตร pgslot เว็บตรงเยอะแยะ หาสไตล์ให้พบก็พอ

สล็อตพีจี pgslot เว็บไซต์ตรง ของ Casinoruby88 pgslot ทำไมถึงเป็น สล็อตแตกหนัก และก็เป็นตัวชูโรงของ สล็อตเว็บตรง Casinoruby88?

สล็อตพีจี pgslot เว็บไซต์ตรง ของ Casinoruby88 pgslot ทำไมถึงเป็น สล็อตแตกหนัก และก็เป็นตัวชูโรงของ สล็อตเว็บตรง Casinoruby88?

pgslot pgslot ผู้ให้บริการเว็บสล็อตออนไลน์ ที่มีชื่อเสียงมีชื่อเสียง เป็นอย่างมากในทวีปเอเชีย

pgslot pgslot ผู้ให้บริการเว็บสล็อตออนไลน์ ที่มีชื่อเสียงมีชื่อเสียง เป็นอย่างมากในทวีปเอเชีย auto-pgslot pgslot pgslotx.co 29 JUL 66 Hugo ดาวน์โหลดง่าย

auto-pgslot pgslot pgslotx.co 29 JUL 66 Hugo ดาวน์โหลดง่าย

สล็อตpg ทดลองเล่นสล็อต ทดสอบเล่นpg กับ freeslot168 เว็บสล็อตของจริงตัวตึงระดับสากล

สล็อตpg ทดลองเล่นสล็อต ทดสอบเล่นpg กับ freeslot168 เว็บสล็อตของจริงตัวตึงระดับสากล ทำไมเราถึงเป็นตัวท็อปของ ทดลองเล่นpg นี่อาจจะเป็นปัญหาที่ดี หากคุณไม่เคยรู้จะเรามาก่อน เพราะเหตุว่าในวงการ สล็อตออนไลน์ ทุกภาคส่วนทราบ ว่า สล็อตpg เป็นตังเต็งระดับโลกเกี่ยวกับการเดิมสล็อตออนไลน์ สล็อตpg ยืนหนึ่งมาเสมอ สล็อตpg ทดสอบเล่นสล็อต ทดสอบเล่นpg ที่ตามมาตรฐานที่สุดมันแน่นอนว่าจะต้องเป็นพวกเรา เพราะว่าเราเป็นสายตรงจาก Pg soft ค่ายสล็อต ลำดับที่หนึ่งของทวีปเอเชียแปซิฟิก ด้วยระบบปฏิบัติการที่ล้ำสมัย เข้าถึงทุกคน เล่นง่าย แตกหนัก จ่ายจริง แค่ชื่อเว็บก็เข้าใจแล้ว ว่าพวกเรานี่แหละ เป็นตัวจริงของ สล็อตpg ทดสอบเล่นสล็อต ทดลองเล่นpg ค่ายสล็อตที่ทุกคนต่างใฝ่ฝัน freeslot168 จัดให้จ้า

ทำไมเราถึงเป็นตัวท็อปของ ทดลองเล่นpg นี่อาจจะเป็นปัญหาที่ดี หากคุณไม่เคยรู้จะเรามาก่อน เพราะเหตุว่าในวงการ สล็อตออนไลน์ ทุกภาคส่วนทราบ ว่า สล็อตpg เป็นตังเต็งระดับโลกเกี่ยวกับการเดิมสล็อตออนไลน์ สล็อตpg ยืนหนึ่งมาเสมอ สล็อตpg ทดสอบเล่นสล็อต ทดสอบเล่นpg ที่ตามมาตรฐานที่สุดมันแน่นอนว่าจะต้องเป็นพวกเรา เพราะว่าเราเป็นสายตรงจาก Pg soft ค่ายสล็อต ลำดับที่หนึ่งของทวีปเอเชียแปซิฟิก ด้วยระบบปฏิบัติการที่ล้ำสมัย เข้าถึงทุกคน เล่นง่าย แตกหนัก จ่ายจริง แค่ชื่อเว็บก็เข้าใจแล้ว ว่าพวกเรานี่แหละ เป็นตัวจริงของ สล็อตpg ทดสอบเล่นสล็อต ทดลองเล่นpg ค่ายสล็อตที่ทุกคนต่างใฝ่ฝัน freeslot168 จัดให้จ้า สล็อตpg ทดสอบเล่นสล็อต ทดลองเล่นpg จาก freeslot168 แตกหนักแจกจริงไหม?

สล็อตpg ทดสอบเล่นสล็อต ทดลองเล่นpg จาก freeslot168 แตกหนักแจกจริงไหม?

เล่น

เล่น

โปรโมชั่น Unlimit ฝากไม่มีขั้นต่ำ ถอนได้ไม่ยั้ง ทุนน้อยหรือทุนครึ้มก็เล่นได้ ทดลองเลย!

โปรโมชั่น Unlimit ฝากไม่มีขั้นต่ำ ถอนได้ไม่ยั้ง ทุนน้อยหรือทุนครึ้มก็เล่นได้ ทดลองเลย! ผมมั่นใจว่าหลายๆคนเป็นแบบผมก็คือ บางเวลาก็ต้องการเล่นสล็อตออนไลน์ในแอพลิเคชั่น แต่ว่าบางเวลาก็ต้องการเล่นบนจอคอมพิวเตอร์ใหญ่ๆไม่ต้องการดาวน์โหลดแอพลิเคชั่นอะไรก็ตามติดโทรศัพท์มือถืออะไร ซึ่งเรา joker123 ก็รู้ถึงความอยากได้ในเรื่องนี้ดีนะครับ ฉะนั้น การเล่นโจ๊กเกอร์123นั้น คุณสามารถเลือกได้เลยขอรับ จะดาวน์โหลดแอพลิเคชั่นผ่านระบบ iOS หรือ Android ก็ได้เลย เล่นบนโทรศัพท์เคลื่อนที่หรือแท็ปเล็ตได้แบบลื่นๆไม่มีค้าง ไม่มีสะดุด แอพลิเคชั่นเสถียรแบบสุดๆเลยล่ะครับ แต่หากใครที่ไม่ต้องการที่จะอยากเล่นบนแอพลิเคชั่น ก็สามารถเล่นบนเว็บไซต์บราวเซอร์ต่างๆได้เลย ซึ่งก็จะนำมาซึ่งการทำให้คุณสามารถเล่น joker123 บนคอมพิวเตอร์ได้เลย คนใดกันที่ชอบเล่นจอใหญ่ๆแบบผมก็สบายเลยขอรับ เล่นเพลินเกินยับยั้งใจกันไปเลย คนใดกันแน่พึงพอใจต้องการทดสอบเล่นสล็อตก็มาลงทะเบียนเป็นสมาชิกกับพวกเราได้เลยที่ joker123.money ครับผม

ผมมั่นใจว่าหลายๆคนเป็นแบบผมก็คือ บางเวลาก็ต้องการเล่นสล็อตออนไลน์ในแอพลิเคชั่น แต่ว่าบางเวลาก็ต้องการเล่นบนจอคอมพิวเตอร์ใหญ่ๆไม่ต้องการดาวน์โหลดแอพลิเคชั่นอะไรก็ตามติดโทรศัพท์มือถืออะไร ซึ่งเรา joker123 ก็รู้ถึงความอยากได้ในเรื่องนี้ดีนะครับ ฉะนั้น การเล่นโจ๊กเกอร์123นั้น คุณสามารถเลือกได้เลยขอรับ จะดาวน์โหลดแอพลิเคชั่นผ่านระบบ iOS หรือ Android ก็ได้เลย เล่นบนโทรศัพท์เคลื่อนที่หรือแท็ปเล็ตได้แบบลื่นๆไม่มีค้าง ไม่มีสะดุด แอพลิเคชั่นเสถียรแบบสุดๆเลยล่ะครับ แต่หากใครที่ไม่ต้องการที่จะอยากเล่นบนแอพลิเคชั่น ก็สามารถเล่นบนเว็บไซต์บราวเซอร์ต่างๆได้เลย ซึ่งก็จะนำมาซึ่งการทำให้คุณสามารถเล่น joker123 บนคอมพิวเตอร์ได้เลย คนใดกันที่ชอบเล่นจอใหญ่ๆแบบผมก็สบายเลยขอรับ เล่นเพลินเกินยับยั้งใจกันไปเลย คนใดกันแน่พึงพอใจต้องการทดสอบเล่นสล็อตก็มาลงทะเบียนเป็นสมาชิกกับพวกเราได้เลยที่ joker123.money ครับผม.png) เรื่องน่ารู้ หลังรั้ว สวนสุนันทา ศึกษาก่อนเข้าชั้นเรียน

เรื่องน่ารู้ หลังรั้ว สวนสุนันทา ศึกษาก่อนเข้าชั้นเรียน สำหรับ

สำหรับ

น้องๆที่จะจัดแจงเข้า

น้องๆที่จะจัดแจงเข้า 1.ไม่สมควรเลือกแผนกตามสหายอย่างเด็ดขาด ความพอใจความสามารถการศึกษาทักษะรวมทั้งการเล่าเรียนมหาวิทยาลัยสวนสุนันทาแต่ละคนไม่เหมือนกัน ซึ่งหลายๆคนบกพร่องสำหรับในการเลือกเรียนตามเพื่อนฝูง ด้วยความที่กลัวที่จะจำต้องไปพบสังคมใหม่ กลัวไม่มีเพื่อนพ้อง กลัวที่จะต้องเรียนด้วยตัวเองโดยไม่มีเพื่อนพ้องเป็นตัวช่วย ซึ่งสิ่งเหล่านี้เกิดขึ้นไม่น้อยเลยทีเดียวโดยเฉพาะอย่างยิ่งปัญหาของเด็กไทยที่ขาดความมั่นใจในตัวเองขาดการซัพพอร์ตจากครอบครัว ก็เลยทำให้เชื่อเพื่อนพ้องมากกว่าเชื่อตัวเอง ซึ่งสิ่งที่น้องๆทำก็คือ ต้องหาสิ่งที่ตนเองถูกใจให้พบก่อนไม่จำเป็นจำเป็นที่จะต้องเรียนเหมือนเพื่อนฝูง และไม่จะต้องกลัวสังคมข้างในมหาวิทยาลัย เนื่องจากว่าคนเราจำเป็นจะต้องไปพบพบสังคมใหม่อยู่ตลอดเวลา เมื่อน้องๆทำงานก็จำเป็นต้องพบกับสหายร่วมงานใหม่อยู่ตลอดเวลา การไปพบเจอลูกค้าก็จำเป็นต้องเปลี่ยนหน้าไปเรื่อยๆการเข้าสังคมเป็นสิ่งที่สำคัญ ไม่ต้องกลัวหากว่าเข้ามาในมหาวิทยาลัยสวนสุนันทา พวกเรามีพี่ๆเพื่อนๆที่จะช่วยแนะนำน้องๆรวมทั้งมีกิจกรรมต่างๆให้ได้ร่วมทำให้หาเพื่อนได้ง่ายดายมากยิ่งขึ้น ไม่ต้องกลัวว่าจะเหงาหงอยโดดเดี่ยวอย่างแน่แท้รวมทั้งเรายังเป็นมหาวิทยาลัยราชภัฏ ชั้น 1 ของสวนสุนันทาทั่วทั้งประเทศ จึงทำให้แน่ใจว่าหลักสูตรการเล่าเรียนการสอนมหาวิทยาลัยราชภัฏของเรานั้นมีการพัฒนาอย่างสม่ำเสมอรวมทั้งบ่อย ซึ่งมีผลงานที่เป็นต้นฉบับทางด้านการสอนงานค้นคว้าวิจัยการบริการด้านวิชาการ รวมถึงการทำนุบำรุงศิลป์และวัฒนธรรม รวมถึงการเข้าสังคมตรงนี้พวกเราเป็นลูกพระนางร่วมกัน ก็เลยทำให้พี่ๆน้องๆของเรารักใคร่กลมเกลียวสามัคคีกัน รอแนะนำให้การช่วยเหลือไม่จำเป็นที่จะต้องมาวิตกกังวลจิตใจ น้องๆม 6 ที่จะเตรียมพร้อมไปสู่สวนสุนันทา ซึ่งเป็นมหาวิทยาลัยในฝันของน้องๆที่จะรอสนับสนุนและสนับสนุนด้านวิชาการพร้อมกันกับคุณงามความดีเพื่อก้าวไปสู่การเป็นมือโปรในการพัฒนาประเทศ

1.ไม่สมควรเลือกแผนกตามสหายอย่างเด็ดขาด ความพอใจความสามารถการศึกษาทักษะรวมทั้งการเล่าเรียนมหาวิทยาลัยสวนสุนันทาแต่ละคนไม่เหมือนกัน ซึ่งหลายๆคนบกพร่องสำหรับในการเลือกเรียนตามเพื่อนฝูง ด้วยความที่กลัวที่จะจำต้องไปพบสังคมใหม่ กลัวไม่มีเพื่อนพ้อง กลัวที่จะต้องเรียนด้วยตัวเองโดยไม่มีเพื่อนพ้องเป็นตัวช่วย ซึ่งสิ่งเหล่านี้เกิดขึ้นไม่น้อยเลยทีเดียวโดยเฉพาะอย่างยิ่งปัญหาของเด็กไทยที่ขาดความมั่นใจในตัวเองขาดการซัพพอร์ตจากครอบครัว ก็เลยทำให้เชื่อเพื่อนพ้องมากกว่าเชื่อตัวเอง ซึ่งสิ่งที่น้องๆทำก็คือ ต้องหาสิ่งที่ตนเองถูกใจให้พบก่อนไม่จำเป็นจำเป็นที่จะต้องเรียนเหมือนเพื่อนฝูง และไม่จะต้องกลัวสังคมข้างในมหาวิทยาลัย เนื่องจากว่าคนเราจำเป็นจะต้องไปพบพบสังคมใหม่อยู่ตลอดเวลา เมื่อน้องๆทำงานก็จำเป็นต้องพบกับสหายร่วมงานใหม่อยู่ตลอดเวลา การไปพบเจอลูกค้าก็จำเป็นต้องเปลี่ยนหน้าไปเรื่อยๆการเข้าสังคมเป็นสิ่งที่สำคัญ ไม่ต้องกลัวหากว่าเข้ามาในมหาวิทยาลัยสวนสุนันทา พวกเรามีพี่ๆเพื่อนๆที่จะช่วยแนะนำน้องๆรวมทั้งมีกิจกรรมต่างๆให้ได้ร่วมทำให้หาเพื่อนได้ง่ายดายมากยิ่งขึ้น ไม่ต้องกลัวว่าจะเหงาหงอยโดดเดี่ยวอย่างแน่แท้รวมทั้งเรายังเป็นมหาวิทยาลัยราชภัฏ ชั้น 1 ของสวนสุนันทาทั่วทั้งประเทศ จึงทำให้แน่ใจว่าหลักสูตรการเล่าเรียนการสอนมหาวิทยาลัยราชภัฏของเรานั้นมีการพัฒนาอย่างสม่ำเสมอรวมทั้งบ่อย ซึ่งมีผลงานที่เป็นต้นฉบับทางด้านการสอนงานค้นคว้าวิจัยการบริการด้านวิชาการ รวมถึงการทำนุบำรุงศิลป์และวัฒนธรรม รวมถึงการเข้าสังคมตรงนี้พวกเราเป็นลูกพระนางร่วมกัน ก็เลยทำให้พี่ๆน้องๆของเรารักใคร่กลมเกลียวสามัคคีกัน รอแนะนำให้การช่วยเหลือไม่จำเป็นที่จะต้องมาวิตกกังวลจิตใจ น้องๆม 6 ที่จะเตรียมพร้อมไปสู่สวนสุนันทา ซึ่งเป็นมหาวิทยาลัยในฝันของน้องๆที่จะรอสนับสนุนและสนับสนุนด้านวิชาการพร้อมกันกับคุณงามความดีเพื่อก้าวไปสู่การเป็นมือโปรในการพัฒนาประเทศ

และก็ทีมงานแอดไม่นของ สล็อต ได้รับการฝึกอบรมเพื่อมีความรู้และมีความเข้าใจที่ลึกซึ้งเกี่ยวกับเกมสล็อตออนไลน์ พร้อมให้บริการและก็ช่วยเหลือผู้เล่นด้วยความเป็นมืออาชีพรวมทั้งเป็นกันเอง ในส่วนของระบบการฝาก-ถอน Cafe444 มีระบบระเบียบการฝากแล้วก็ถอนเงินที่เร็วและไม่เป็นอันตราย รองรับการใช้งานวอเลท เพื่ออำนวยความสะดวกสบายต่อผู้เล่นให้สูงที่สุด

และก็ทีมงานแอดไม่นของ สล็อต ได้รับการฝึกอบรมเพื่อมีความรู้และมีความเข้าใจที่ลึกซึ้งเกี่ยวกับเกมสล็อตออนไลน์ พร้อมให้บริการและก็ช่วยเหลือผู้เล่นด้วยความเป็นมืออาชีพรวมทั้งเป็นกันเอง ในส่วนของระบบการฝาก-ถอน Cafe444 มีระบบระเบียบการฝากแล้วก็ถอนเงินที่เร็วและไม่เป็นอันตราย รองรับการใช้งานวอเลท เพื่ออำนวยความสะดวกสบายต่อผู้เล่นให้สูงที่สุด ดาวน์โหลดพีจีสล็อต pgslot Cafe444.me 3 เมษา Boris ใหม่ cafe44ปลอดภัย100% Top 54

ดาวน์โหลดพีจีสล็อต pgslot Cafe444.me 3 เมษา Boris ใหม่ cafe44ปลอดภัย100% Top 54

• เนื้อหาของเกม สำหรับเกม Rave Party Fever เป็นเกมสล็อตจากค่าย PGSLOT ที่บอกเล่าเรื่องราวของดีเจสาวสวยผมแดงที่อยู่บนปกของเกมนี้นี่แหละครับผม ซึ่งตัวเกมpunpro777มิได้มีสตอรี่อะไรซับซ้อนเหมือนเกมpgslotอื่นๆเลยจ้าขอรับ ผมเชื่อว่า ทางค่าย PG น่าจะต้องการสร้างเกมแนวนี้ขึ้นมาเพื่อให้ทุกคนได้ทราบจักแนวเกมใหม่ๆจากค่าย PG ให้เพิ่มมากขึ้นนี่แหละนะครับ ซึ่งบอกเลยว่า แค่หน้าปกของเกม Rave Party Fever ก็น่าเข้ามาเล่นแล้วล่ะนะครับ

• เนื้อหาของเกม สำหรับเกม Rave Party Fever เป็นเกมสล็อตจากค่าย PGSLOT ที่บอกเล่าเรื่องราวของดีเจสาวสวยผมแดงที่อยู่บนปกของเกมนี้นี่แหละครับผม ซึ่งตัวเกมpunpro777มิได้มีสตอรี่อะไรซับซ้อนเหมือนเกมpgslotอื่นๆเลยจ้าขอรับ ผมเชื่อว่า ทางค่าย PG น่าจะต้องการสร้างเกมแนวนี้ขึ้นมาเพื่อให้ทุกคนได้ทราบจักแนวเกมใหม่ๆจากค่าย PG ให้เพิ่มมากขึ้นนี่แหละนะครับ ซึ่งบอกเลยว่า แค่หน้าปกของเกม Rave Party Fever ก็น่าเข้ามาเล่นแล้วล่ะนะครับ • ข้อมูลของเกม สำหรับข้อมูลของเกม Raze Party Fever เป็นเกมสล็อตออนไลน์แบบ 7 รีล 7 แถว ไม่มีไลน์เดิมพันที่ชนะตามที่ผมบอกเลยครับผม เพราะเกมนี้จะใช้วิธีการนับจำนวนสัญลักษณ์ที่อยู่บนเพลาแทนนะครับ มีสัญลักษณ์ตามที่มีการกำหนดเมื่อใด ก็จ่ายเงินรางวัลตามที่มีการกำหนดนั่นเองขอรับ สามารถเบทได้ตั้งแต่ 1 บาท ไปจนกระทั่งสูงสุดที่ 2,000 บาท และก็แน่นอนว่า ไม่มีการซื้อฟีเจอร์ฟรีสปินครับ

• ข้อมูลของเกม สำหรับข้อมูลของเกม Raze Party Fever เป็นเกมสล็อตออนไลน์แบบ 7 รีล 7 แถว ไม่มีไลน์เดิมพันที่ชนะตามที่ผมบอกเลยครับผม เพราะเกมนี้จะใช้วิธีการนับจำนวนสัญลักษณ์ที่อยู่บนเพลาแทนนะครับ มีสัญลักษณ์ตามที่มีการกำหนดเมื่อใด ก็จ่ายเงินรางวัลตามที่มีการกำหนดนั่นเองขอรับ สามารถเบทได้ตั้งแต่ 1 บาท ไปจนกระทั่งสูงสุดที่ 2,000 บาท และก็แน่นอนว่า ไม่มีการซื้อฟีเจอร์ฟรีสปินครับ • เกมนี้กี่คะแนน? คงไม่ต้องบอกกันเลยนะครับผมว่า ผมชื่นชอบเกม Rave Party Fever เยอะแค่ไหน ด้วยเหตุว่าผมเล่นเกมpgslotที่เป็นเกมที่มีไลน์พนันมาเยอะมากๆแล้ว นานๆครั้งจะได้เล่นเกมpunpro777ที่มีรูปแบบแปลกใหม่ ซึ่งเกมนี้ก็ถือว่าทำออกมาก้าวหน้ามากมายๆเลยล่ะขอรับ ฟีพบร์ต่างๆก็น่าดึงดูดแบบสุดๆอัตราการจ่ายเงินรางวัลก็ดีแล้วอีกด้วย อย่างนี้จะเกลียดได้อย่างไรล่ะครับผมจริงไหม 10 เต็ม 10 คะแนนไปเลยสินะครับ

• เกมนี้กี่คะแนน? คงไม่ต้องบอกกันเลยนะครับผมว่า ผมชื่นชอบเกม Rave Party Fever เยอะแค่ไหน ด้วยเหตุว่าผมเล่นเกมpgslotที่เป็นเกมที่มีไลน์พนันมาเยอะมากๆแล้ว นานๆครั้งจะได้เล่นเกมpunpro777ที่มีรูปแบบแปลกใหม่ ซึ่งเกมนี้ก็ถือว่าทำออกมาก้าวหน้ามากมายๆเลยล่ะขอรับ ฟีพบร์ต่างๆก็น่าดึงดูดแบบสุดๆอัตราการจ่ายเงินรางวัลก็ดีแล้วอีกด้วย อย่างนี้จะเกลียดได้อย่างไรล่ะครับผมจริงไหม 10 เต็ม 10 คะแนนไปเลยสินะครับ

สล็อต จัดเต็มความเพลิดเพลินเต็มแบบจากสล็อตเว็บไซต์ตรงไม่ผ่านเอเย่นต์ เว็บแท้ 100% สมัครเลย!

สล็อต จัดเต็มความเพลิดเพลินเต็มแบบจากสล็อตเว็บไซต์ตรงไม่ผ่านเอเย่นต์ เว็บแท้ 100% สมัครเลย! 5 เทคนิคการเล่นสล็อตออนไลน์กับ

5 เทคนิคการเล่นสล็อตออนไลน์กับ  1. ฝึกเล่นในห้องแลป punpro

1. ฝึกเล่นในห้องแลป punpro

เว็บบริกา

เว็บบริกา ศูนย์รวมเกมสล็อตออนไลน์แตกง่ายได้เงินจริง

ศูนย์รวมเกมสล็อตออนไลน์แตกง่ายได้เงินจริง

วิธีเลือกสล็อตให้เหมาะสมกับตัวเอง

วิธีเลือกสล็อตให้เหมาะสมกับตัวเอง

• Fortune Tiger (พยัคฆ์ที่โชคลาภ) ถ้าเกม Fortune Ox นั้นวาดภาพพี่โคเป็นปกได้หล่อเท่สุดๆแล้ว เกม Fortune Tiger ก็คือขั้วตรงข้ามเลยล่ะขอรับ เนื่องจากว่าทางค่าย PG วาดพี่เสือออกมาได้น่ารักน่าเอ็นดูแบบสุดๆเลยล่ะครับ ฮ่า… ซึ่งเสือนับว่าเป็นสัตว์อันเป็นเครื่องหมายที่สื่อถึงความฉลาดแล้วก็ความกล้าตามความเลื่อมใสของชาวจีน ซึ่งธีมของเกมก็ไม่ได้แตกต่างอะไรกับโคที่โชคลาภเลยล่ะขอรับ โดยเกม

• Fortune Tiger (พยัคฆ์ที่โชคลาภ) ถ้าเกม Fortune Ox นั้นวาดภาพพี่โคเป็นปกได้หล่อเท่สุดๆแล้ว เกม Fortune Tiger ก็คือขั้วตรงข้ามเลยล่ะขอรับ เนื่องจากว่าทางค่าย PG วาดพี่เสือออกมาได้น่ารักน่าเอ็นดูแบบสุดๆเลยล่ะครับ ฮ่า… ซึ่งเสือนับว่าเป็นสัตว์อันเป็นเครื่องหมายที่สื่อถึงความฉลาดแล้วก็ความกล้าตามความเลื่อมใสของชาวจีน ซึ่งธีมของเกมก็ไม่ได้แตกต่างอะไรกับโคที่โชคลาภเลยล่ะขอรับ โดยเกม pgslot เข้าสู่ระบบ pgslot fullslotpg.tv 6 เม.ย. Angeline โอนไว

pgslot เข้าสู่ระบบ pgslot fullslotpg.tv 6 เม.ย. Angeline โอนไว

PUNPRO777 สล็อตเว็บไซต์ตรงแตกหนัก จัดเต็มทุกค่ายเกมดังระดับโลกมากมายก่ายกอง รับประกันความปังแล้ววันนี้ สมัครเลย!

PUNPRO777 สล็อตเว็บไซต์ตรงแตกหนัก จัดเต็มทุกค่ายเกมดังระดับโลกมากมายก่ายกอง รับประกันความปังแล้ววันนี้ สมัครเลย! หากว่าแนวทางการทำกำไรจากการเล่นสล็อตออนไลน์เป็นสิ่งที่คุณปรารถนาล่ะก็ มาลองใช้บริการกับพวกเรา

หากว่าแนวทางการทำกำไรจากการเล่นสล็อตออนไลน์เป็นสิ่งที่คุณปรารถนาล่ะก็ มาลองใช้บริการกับพวกเรา  โปรโมชั่นฝากแรกของวันจาก PUNPRO ให้คุณเริ่มวันใหม่ด้วยเงินลงทุนที่มากขึ้นแบบง่ายๆลองเลย!

โปรโมชั่นฝากแรกของวันจาก PUNPRO ให้คุณเริ่มวันใหม่ด้วยเงินลงทุนที่มากขึ้นแบบง่ายๆลองเลย! เล่นสล็อตออนไลน์กับ PUNPRO777 ได้แบบไม่มีอันตราย 100% กับระบบฝากถอนออโต้ที่เยี่ยมที่สุดเดี๋ยวนี้

เล่นสล็อตออนไลน์กับ PUNPRO777 ได้แบบไม่มีอันตราย 100% กับระบบฝากถอนออโต้ที่เยี่ยมที่สุดเดี๋ยวนี้ มองหาทางเข้าPG มองหาเรา สล็อต pg เว็บตรงไม่ผ่านเอเย่นต์ เว็บไซต์ตรงแท้ 100% พร้อมบริการแล้ว สมัครเลย!

มองหาทางเข้าPG มองหาเรา สล็อต pg เว็บตรงไม่ผ่านเอเย่นต์ เว็บไซต์ตรงแท้ 100% พร้อมบริการแล้ว สมัครเลย! เทคนิคปราบเกมสล็อตออนไลน์แบบง่ายๆสไตล์ pg slot ที่ไม่ว่าใครก็สามารถทำเป็นแน่ๆ

เทคนิคปราบเกมสล็อตออนไลน์แบบง่ายๆสไตล์ pg slot ที่ไม่ว่าใครก็สามารถทำเป็นแน่ๆ • สล็อต pg ทดสอบเล่นให้ชิน การเข้าไปเรียนหรือพินิจเกมสล็อตเป็นสิ่งจำเป็น แต่ว่าหากคุณต้องการทราบว่าเกมนั้นๆเป็นอย่างไรล่ะก็ คุณก็ต้องทดลองเล่นมันไปด้วย ซึ่งหากคุณควรต้องเพิ่มเติมเงินและก็เข้าเล่น มันก็บางทีอาจจะสิ้นเปลืองก็ได้ กว่าคุณจะรู้ดีว่า

• สล็อต pg ทดสอบเล่นให้ชิน การเข้าไปเรียนหรือพินิจเกมสล็อตเป็นสิ่งจำเป็น แต่ว่าหากคุณต้องการทราบว่าเกมนั้นๆเป็นอย่างไรล่ะก็ คุณก็ต้องทดลองเล่นมันไปด้วย ซึ่งหากคุณควรต้องเพิ่มเติมเงินและก็เข้าเล่น มันก็บางทีอาจจะสิ้นเปลืองก็ได้ กว่าคุณจะรู้ดีว่า

• Slotxo24hr หนึ่งในเว็บ pgslot สายตรงจากค่าย slotxo มาเปิดให้บริการในประเทศไทยในแบบเว็บไซต์ตรงเป็นเจ้าแรกของประเทศ และปัจจุบันก็ยังเปิดให้บริการอยู่ บอกเลยว่าไม่ธรรมดาอย่างไม่ต้องสงสัย ไปลองเลย!

• Slotxo24hr หนึ่งในเว็บ pgslot สายตรงจากค่าย slotxo มาเปิดให้บริการในประเทศไทยในแบบเว็บไซต์ตรงเป็นเจ้าแรกของประเทศ และปัจจุบันก็ยังเปิดให้บริการอยู่ บอกเลยว่าไม่ธรรมดาอย่างไม่ต้องสงสัย ไปลองเลย! 1. อย่างแรกเลย พวกเราจำเป็นต้องเลือกหาเว็บที่มี License แท้หรือมี Certificate อย่างถูกต้อง ซึ่งเว็บตรงของจริง พวกใบเซอร์เหล่านี้ จะหาดูได้ในหน้าเว็บไซต์ไม่ยาก เพราะเหตุว่ามันนับว่าเป็นสิ่งชี้นำวัดได้เลยว่า เว็บไซต์ไหนเป็นของจริงและน่าเล่น!

1. อย่างแรกเลย พวกเราจำเป็นต้องเลือกหาเว็บที่มี License แท้หรือมี Certificate อย่างถูกต้อง ซึ่งเว็บตรงของจริง พวกใบเซอร์เหล่านี้ จะหาดูได้ในหน้าเว็บไซต์ไม่ยาก เพราะเหตุว่ามันนับว่าเป็นสิ่งชี้นำวัดได้เลยว่า เว็บไซต์ไหนเป็นของจริงและน่าเล่น! • สูตรการซื้อฟรีสปิน : การซื้อฟรีสปินก็ไม่มีอะไรมาก โดยสูตรนี้จะค่อนข้างยืนยันว่าจะไม่ขาดทุนราวๆ 8i0% กันอย่างยิ่งจริงๆเชียวแรง โดยกรรมวิธีก็ไม่ยาก แค่เพียงหาหน้าที่มี symbol ซ้ำกันมากยิ่งกว่า 10 ตัวขึ้นไป แล้วให้กดซื้อ

• สูตรการซื้อฟรีสปิน : การซื้อฟรีสปินก็ไม่มีอะไรมาก โดยสูตรนี้จะค่อนข้างยืนยันว่าจะไม่ขาดทุนราวๆ 8i0% กันอย่างยิ่งจริงๆเชียวแรง โดยกรรมวิธีก็ไม่ยาก แค่เพียงหาหน้าที่มี symbol ซ้ำกันมากยิ่งกว่า 10 ตัวขึ้นไป แล้วให้กดซื้อ ขอขอบพระคุณweb

ขอขอบพระคุณweb  • เว็บไซต์ผู้แทนสายตรงจาก slog เว็บแรก จะต้องเป็นเว็บไซต์ของพวกเราแค่นั้น pgslotth เนื่องจากว่าเนื่องจากเราเป็นสายตรง เราเลยจำเป็นจะต้องดีเยี่ยมที่สุด เพื่อมอบประสบการณ์สำหรับการเล่นสล็อตพีจีที่เยี่ยมที่สุดให้กับนักลงทุนทุกท่านนั่นเองแรง

• เว็บไซต์ผู้แทนสายตรงจาก slog เว็บแรก จะต้องเป็นเว็บไซต์ของพวกเราแค่นั้น pgslotth เนื่องจากว่าเนื่องจากเราเป็นสายตรง เราเลยจำเป็นจะต้องดีเยี่ยมที่สุด เพื่อมอบประสบการณ์สำหรับการเล่นสล็อตพีจีที่เยี่ยมที่สุดให้กับนักลงทุนทุกท่านนั่นเองแรง ความหมายของผลรวมเลขทะเบียนรถตามศาสตร์ที่

ความหมายของผลรวมเลขทะเบียนรถตามศาสตร์ที่ ตามหาเว็บหนังออนไลน์ ตามหาดูมูฟวี่ได้เลย ดูหนังดี ซีรีส์ดัง ได้ตลอดวัน ลองเลย!

ตามหาเว็บหนังออนไลน์ ตามหาดูมูฟวี่ได้เลย ดูหนังดี ซีรีส์ดัง ได้ตลอดวัน ลองเลย! ถึงเวลาสนุกกับชั่วโมงแห่งการดูหนังกันแล้ว! มาขอรับทุกคน ถ้าหากคุณกำลังอยากได้ดูหนังผ่านเน็ตล่ะก็ มาทดลองใช้บริการเว็บหนังออนไลน์ของเรา ดูหนังออนไลน์ กันไหมล่ะนะครับ พวกเราเป็นเว็บดูหนังที่เปิดให้บริการตลอด 1 วัน มีหนังและก็ซีรีส์ดีๆจำนวนมากกว่า 5,000 เรื่อง ไม่พลาดทุกตอนใหม่ของซีรีส์ ไม่พลาดทุกหนังเข้าใหม่ชนโรง สามารถดูได้ทั้งวัน

ถึงเวลาสนุกกับชั่วโมงแห่งการดูหนังกันแล้ว! มาขอรับทุกคน ถ้าหากคุณกำลังอยากได้ดูหนังผ่านเน็ตล่ะก็ มาทดลองใช้บริการเว็บหนังออนไลน์ของเรา ดูหนังออนไลน์ กันไหมล่ะนะครับ พวกเราเป็นเว็บดูหนังที่เปิดให้บริการตลอด 1 วัน มีหนังและก็ซีรีส์ดีๆจำนวนมากกว่า 5,000 เรื่อง ไม่พลาดทุกตอนใหม่ของซีรีส์ ไม่พลาดทุกหนังเข้าใหม่ชนโรง สามารถดูได้ทั้งวัน ชวนดูหนังจากจักรวาล Marvel สะสมเอาไว้ในที่เดียวให้คุณ กับหมู่ รวมหนังภาคต่อ

ชวนดูหนังจากจักรวาล Marvel สะสมเอาไว้ในที่เดียวให้คุณ กับหมู่ รวมหนังภาคต่อ

1. สล็อตเว็บไซต์ตรงไม่ผ่านเอเย่นต์

1. สล็อตเว็บไซต์ตรงไม่ผ่านเอเย่นต์ 3. ระบบฝากถอนมีความน่าไว้วางใจและความปลอดภัย

3. ระบบฝากถอนมีความน่าไว้วางใจและความปลอดภัย ลงทะเบียนเป็นสมาชิกกับเราได้แล้ววันนี้ สมัครฟรีไม่ต้องจ่ายเงินใดๆทั้งหมด สมัครเลยกับ PG77 แค่นั้น!

ลงทะเบียนเป็นสมาชิกกับเราได้แล้ววันนี้ สมัครฟรีไม่ต้องจ่ายเงินใดๆทั้งหมด สมัครเลยกับ PG77 แค่นั้น! เว็บpg slotทั้งหมด pgslot

เว็บpg slotทั้งหมด pgslot  168slot ถือได้ว่า เว็บทางเลือก สำหรับใครหลายๆคน ที่อยากจะร่วมสนุกสนาน ไปกับการลงทุน อย่างมากมาย ไปกับการผลิตรายได้ อย่างยอดเยี่ยม แล้วก็เป็นการปรากฏ อันล้ำค่า ที่คุณหาไม่ได้ จากที่ไหนอย่างแน่แท้ ถ้าหากได้ลองที่นี่ จำเป็นจะต้องชอบใจ กับการให้บริการ ที่เปรียบได้ดั่ง ลูกค้า Super VIP ที่เว็บอื่นๆไม่สามารถทำเป็น ไม่ว่าจะเป็นอีกทั้ง การติดต่อถามไถ่ ผ่านทีมงาน โดยตรง 1 วัน หรือ รวมถึงการให้บริการต่างๆที่รองรับระบบ การคลังทุกแบบอย่าง อย่างดีเยี่ยม มีความจำเป็น ในทุกคุณภาพ มีความพร้อม ในทุกการบริการ แล้วก็เชื่อถือได้เลยว่า สิ่งเหล่านี้ คือ อีกหนึ่งบริการที่มีความน่าประทับใจ สิ่งเหล่านี้ เป็นอีกหนึ่งประสิทธิภาพ ที่มีความยอดเยี่ยม ในทุกแบบ ของการผลิตรายได้ที่ดี มีคุณประโยชน์อย่างสูงที่สุด ที่คุณสามารถ สมัครสมาชิกได้แล้ว วันนี้ ที่นี่เลย 168slot.win

168slot ถือได้ว่า เว็บทางเลือก สำหรับใครหลายๆคน ที่อยากจะร่วมสนุกสนาน ไปกับการลงทุน อย่างมากมาย ไปกับการผลิตรายได้ อย่างยอดเยี่ยม แล้วก็เป็นการปรากฏ อันล้ำค่า ที่คุณหาไม่ได้ จากที่ไหนอย่างแน่แท้ ถ้าหากได้ลองที่นี่ จำเป็นจะต้องชอบใจ กับการให้บริการ ที่เปรียบได้ดั่ง ลูกค้า Super VIP ที่เว็บอื่นๆไม่สามารถทำเป็น ไม่ว่าจะเป็นอีกทั้ง การติดต่อถามไถ่ ผ่านทีมงาน โดยตรง 1 วัน หรือ รวมถึงการให้บริการต่างๆที่รองรับระบบ การคลังทุกแบบอย่าง อย่างดีเยี่ยม มีความจำเป็น ในทุกคุณภาพ มีความพร้อม ในทุกการบริการ แล้วก็เชื่อถือได้เลยว่า สิ่งเหล่านี้ คือ อีกหนึ่งบริการที่มีความน่าประทับใจ สิ่งเหล่านี้ เป็นอีกหนึ่งประสิทธิภาพ ที่มีความยอดเยี่ยม ในทุกแบบ ของการผลิตรายได้ที่ดี มีคุณประโยชน์อย่างสูงที่สุด ที่คุณสามารถ สมัครสมาชิกได้แล้ว วันนี้ ที่นี่เลย 168slot.win เชื่อถือใน 168slot พร้อมทำเงินให้แก่ท่านแล้ว

เชื่อถือใน 168slot พร้อมทำเงินให้แก่ท่านแล้ว

3. เปิดเว็บพนัน hyperxtech ระบบ Check-in ประจำวัน

3. เปิดเว็บพนัน hyperxtech ระบบ Check-in ประจำวัน 7. ระบบ Affilate (แนะนำเพื่อน)

7. ระบบ Affilate (แนะนำเพื่อน) 9. ระบบตัวคูณยอดฝาก (ได้ยอดฝากเพิ่ม สุ่มรีเทิร์น อั้นถอน)

9. ระบบตัวคูณยอดฝาก (ได้ยอดฝากเพิ่ม สุ่มรีเทิร์น อั้นถอน) 10. บทความหน้าเว็บ รับทำเว็บพนัน

10. บทความหน้าเว็บ รับทำเว็บพนัน ถ้าคุณพอใจมาเล่นเกมสล็อตที่เว็บของเรา เราขอชี้แนะโปรโมชั่น pgslot ที่มีความน่าสนใจ โดยที่คุณสามารถบันเทิงใจกับมันได้โดยไม่เบื่อ ดังต่อไปนี้

ถ้าคุณพอใจมาเล่นเกมสล็อตที่เว็บของเรา เราขอชี้แนะโปรโมชั่น pgslot ที่มีความน่าสนใจ โดยที่คุณสามารถบันเทิงใจกับมันได้โดยไม่เบื่อ ดังต่อไปนี้ ถ้าคุณมาเล่น pgslot ที่เว็บของพวกเรา คุณจะได้รับเครดิตไปเล่นสล็อตได้เลยในทันที ซึ่งข้อดีของเครดิตฟรีมีจำนวนมาก โดยที่คุณคิดไม่ถึงดังต่อไปนี้

ถ้าคุณมาเล่น pgslot ที่เว็บของพวกเรา คุณจะได้รับเครดิตไปเล่นสล็อตได้เลยในทันที ซึ่งข้อดีของเครดิตฟรีมีจำนวนมาก โดยที่คุณคิดไม่ถึงดังต่อไปนี้ แนวทางการลงทะเบียนสมัครสมาชิก

แนวทางการลงทะเบียนสมัครสมาชิก

Pgslot temmax69 เกมสล็อตสุดมันส์ พร้อมโปรโมชั่น แถมเครดิตฟรีอีกเพียบเลย

Pgslot temmax69 เกมสล็อตสุดมันส์ พร้อมโปรโมชั่น แถมเครดิตฟรีอีกเพียบเลย เว็บ temmax69 คือเกมสล็อตสุดมันส์ ถูกใจ แตกหนัก ที่จะทำให้คุณเปิดโลกความสนุกสนานได้แบบไม่สิ้นสุด พวกเราเป็นเว็บพนันออนไลน์ที่ใหญ่ที่สุดในไทย นำเข้าเกมสล็อตเว็บตรงจากต่างแดนมากมาย ถ้าคุณมาเล่นสล็อต ที่เว็บของพวกเรา คุณจะบันเทิงใจมันส์กับโปรโมชั่น pgslot มากไม่น้อยเลยทีเดียวดังนี้ โปรโมชั่นโปรเด็ดวันอาทิตย์, โปรโมชั่นเล่นเสียหายห่วงได้คืนทุกยอด, โปรโมชั่นรับเครดิตฟรีวันเกิด 300 บาท รวมทั้ง โปรโมชั่นฝากตลอดทั้งวันแบบอัลลิมิเต็ด แจกโบนัส 10% เป็นต้น แค่นั้นยังมีพอเว็บพวกเรายังมี

เว็บ temmax69 คือเกมสล็อตสุดมันส์ ถูกใจ แตกหนัก ที่จะทำให้คุณเปิดโลกความสนุกสนานได้แบบไม่สิ้นสุด พวกเราเป็นเว็บพนันออนไลน์ที่ใหญ่ที่สุดในไทย นำเข้าเกมสล็อตเว็บตรงจากต่างแดนมากมาย ถ้าคุณมาเล่นสล็อต ที่เว็บของพวกเรา คุณจะบันเทิงใจมันส์กับโปรโมชั่น pgslot มากไม่น้อยเลยทีเดียวดังนี้ โปรโมชั่นโปรเด็ดวันอาทิตย์, โปรโมชั่นเล่นเสียหายห่วงได้คืนทุกยอด, โปรโมชั่นรับเครดิตฟรีวันเกิด 300 บาท รวมทั้ง โปรโมชั่นฝากตลอดทั้งวันแบบอัลลิมิเต็ด แจกโบนัส 10% เป็นต้น แค่นั้นยังมีพอเว็บพวกเรายังมี  สายpgslotเว็บตรงห้ามพลาด 1xbetth กลับมาเปิดให้บริการแล้ววันนี้!

สายpgslotเว็บตรงห้ามพลาด 1xbetth กลับมาเปิดให้บริการแล้ววันนี้! • ระบบการเล่นเกมslot ที่เสถียรแล้วก็ลื่นไหลมากที่สุดในทวีปเอเชีย พวกเราได้นำเข้าระบบนี้มาเปิดให้บริการกับทุกคนอย่างเต็มรูปแบบ โดยผ่านการตรวจสอบจากองการคาสิโนโลกรวมทั้งทีมงานสล็อตเว็บไซต์ตรงทุกภาคส่วน ด้วยราคาเป็นอันมาก กว่าที่เราจะได้ระบบนี้มา บอกเลยว่า เร็ว แรง ทะลุแดนนรก อย่างไม่ต้องสงสัย!

• ระบบการเล่นเกมslot ที่เสถียรแล้วก็ลื่นไหลมากที่สุดในทวีปเอเชีย พวกเราได้นำเข้าระบบนี้มาเปิดให้บริการกับทุกคนอย่างเต็มรูปแบบ โดยผ่านการตรวจสอบจากองการคาสิโนโลกรวมทั้งทีมงานสล็อตเว็บไซต์ตรงทุกภาคส่วน ด้วยราคาเป็นอันมาก กว่าที่เราจะได้ระบบนี้มา บอกเลยว่า เร็ว แรง ทะลุแดนนรก อย่างไม่ต้องสงสัย! • ระบบ interface หรือระบบหน้าเว็บ กรรมวิธีทุกๆสิ่งทุกๆอย่างที่อยู่ที่หน้าเว็บของพวกเรา ที่ยกเว้นพวกเกมต่างๆพวกเราแก้ไขใหม่ให้มีความทันยุคทันสมัยแล้วก็เข้ากับความเป็นตอนนี้ของสาวกสล็อตออนไลน์มากที่สุดนั่นเองแรง โดยระบบที่พูดถึงก็มีอยู่นานัปการระบบ ไม่ว่าจะเป็น

• ระบบ interface หรือระบบหน้าเว็บ กรรมวิธีทุกๆสิ่งทุกๆอย่างที่อยู่ที่หน้าเว็บของพวกเรา ที่ยกเว้นพวกเกมต่างๆพวกเราแก้ไขใหม่ให้มีความทันยุคทันสมัยแล้วก็เข้ากับความเป็นตอนนี้ของสาวกสล็อตออนไลน์มากที่สุดนั่นเองแรง โดยระบบที่พูดถึงก็มีอยู่นานัปการระบบ ไม่ว่าจะเป็น